Loading

Get Vat600aa/frs Application To Join The Annual Accounting Scheme And Flat Rate Scheme. Application To

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

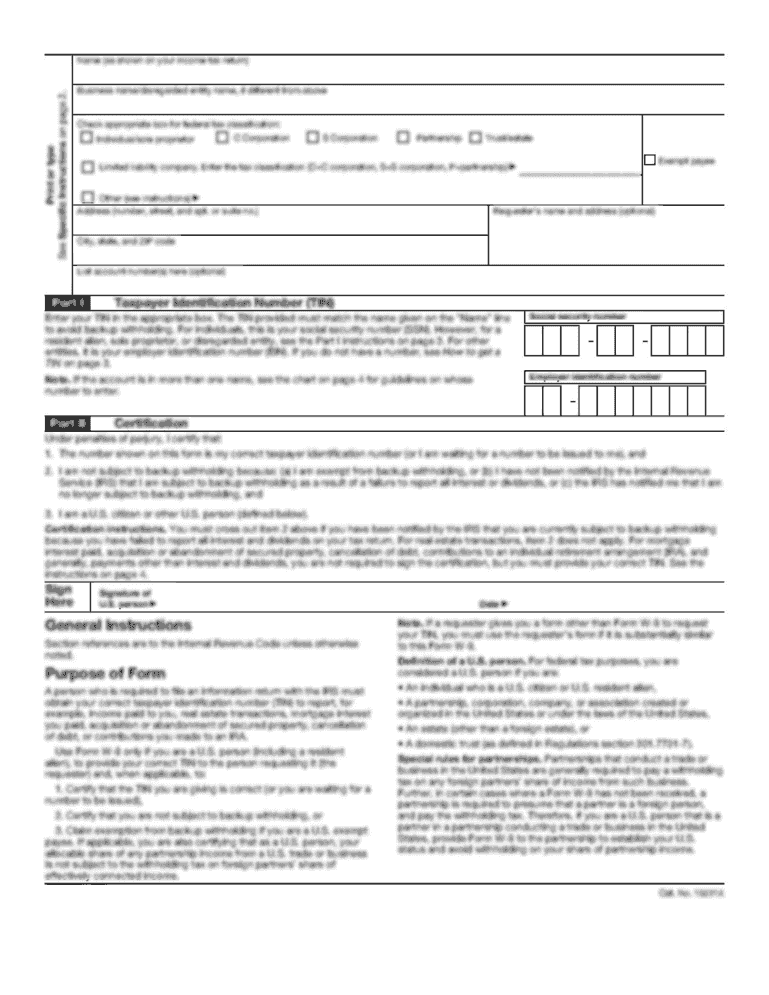

How to fill out the VAT600AA/FRS Application To Join The Annual Accounting Scheme And Flat Rate Scheme online

Filling out the VAT600AA/FRS application is an essential step for those looking to join the annual accounting and flat rate schemes. This guide provides clear instructions for completing the application online, ensuring ease and accuracy.

Follow the steps to successfully complete your application.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Fill in your business name and address in the designated sections. Ensure that all information is accurate to avoid processing delays.

- Provide your business phone number, and if known, your VAT registration number and postcode.

- Indicate your preferred end month for the annual accounting year by stating the last day of that month.

- For the Flat Rate Scheme, describe your main business activity clearly.

- Enter the flat rate percentage relevant to your trade sector as stated in Notice 733. This information is crucial for accurate tax calculation.

- Choose when you wish to start using the Flat Rate Scheme and specify the start date if different than the next accounting period.

- Indicate your preferred method of payment for interim payments by marking an X in the appropriate box, and if choosing Direct Debit, provide your bank account details.

- Complete the declaration section, confirming that the information provided is true and that you are eligible for the schemes.

- Upon completing the form, review all entered information for accuracy. Save your changes and download or print the form if needed.

- Send the completed form along with any required supporting documents to HMRC National Registration Unit at the specified address.

Get started now by filling out your VAT600AA/FRS application online.

You'll first need to check that you're eligible for the VAT Flat Rate Scheme. If you're eligible, you can join the scheme online when you register for VAT, or submit the VAT600 FRS through one of the methods below: By email to frsapplications.vrs@hmrc.gsi.gov.uk.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.