Loading

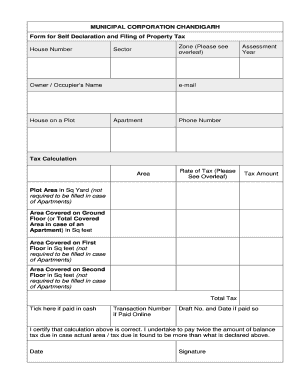

Get Form For Self Declaration And Filing Of Property Tax

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form For Self Declaration And Filing Of Property Tax online

Filing your property tax can be a straightforward process when you understand how to complete the Form For Self Declaration And Filing Of Property Tax online. This guide will provide step-by-step instructions to ensure you fill out the form accurately and efficiently.

Follow the steps to complete your property tax form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your House Number in the designated field to identify your property accurately.

- Select your Zone as indicated overleaf to classify your property’s location.

- Input your Sector number to provide additional property location details.

- Fill in the Owner / Occupier’s Name, ensuring accuracy for identification purposes.

- Indicate if your property is a House on a Plot or Apartment by selecting the relevant option.

- Input the Assessment Year for which you are filing the tax to specify the relevant tax period.

- Provide your email address for future correspondence regarding your property tax.

- Enter your Phone Number where you can be reached for inquiries related to your filing.

- Specify the Tax Calculation Area to assist in determining your tax obligations.

- Refer to the Rate of Tax section overleaf to know the applicable rate for your property type.

- Automatically calculate the Tax Amount based on the area and rate of tax you have entered.

- If applicable, provide the Plot Area in Sq Yard; skip if your property is an Apartment.

- Indicate the Area Covered on Ground Floor or Total Covered Area in case of an Apartment in Sq feet.

- If applicable, include the Area Covered on First Floor and Second Floor in Sq feet for non-Apartment properties.

- Total the tax amount due to finalize your payment information.

- Tick the box if the tax has been paid in cash. If paid online, enter the Transaction Number.

- If you have paid by Draft, include the Draft Number and the date of payment.

- Review the certification statement to ensure correctness, and provide the Date and your Signature at the end.

- After completing the form, save your changes, download, print, or share the form as needed.

Ensure your property tax is filed correctly by completing the required documents online today.

Related links form

Declarations must be submitted by February 2, 2023 to identify the occupancy status of the property for the 2022 calendar year. Declarations may also be submitted online by visiting: .toronto.ca\VacantHomeTax. A declaration is not required if the residential property does not contain a residential unit.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.