Loading

Get Iht416

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IHT416 online

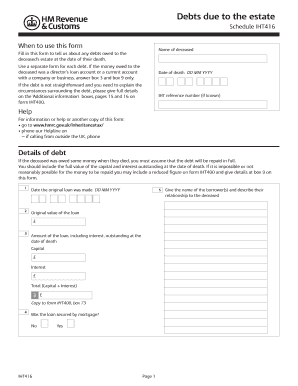

The IHT416 form is used to report any debts owed to a deceased person's estate at the time of their death. This guide provides a step-by-step approach to completing the form online for individuals who may not have extensive legal experience.

Follow the steps to accurately complete the IHT416 form

- Click ‘Get Form’ button to obtain the IHT416 form and open it for editing.

- Enter the name of the deceased in the designated field. This should be the full legal name as it appears in official documentation.

- Input the date of death using the format DD MM YYYY. Ensure this date is accurate, as it is crucial for processing.

- If you know the IHT reference number, enter it in the designated field. This can help streamline the processing of the form.

- Fill out the details of the debt. Include the date the original loan was made and the original value of the loan in GBP.

- Enter the total amount of the loan outstanding at the date of death, which includes both the capital and interest amounts.

- Indicate whether the loan was secured by a mortgage by checking 'Yes' or 'No'.

- Provide detailed information about the interest charged on the loan, including the rates and duration over which it was charged.

- List any capital repayments made on the loan, or provide explanation in the additional details section if needed.

- Describe what evidence supports the existence of the loan. This should include any written documents such as letters or mortgage deeds.

- If necessary, explain any variances in the figures reported, and include supportive evidence for those adjustments.

- Once all sections are filled out, review your entries for accuracy. Save your changes, and you can choose to download, print, or share the completed form.

Take action now to complete the IHT416 form online, ensuring your submissions are accurate and timely.

Form IHT400 is the full IHT account. This must be completed where there is IHT to pay or the deceased's estate does not qualify as an excepted estate. An application for a reference number is made on form IHT422. ...

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.