Loading

Get Iht 415

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Iht 415 online

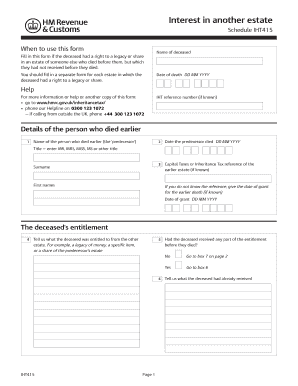

The Iht 415 form is crucial for individuals who need to declare their entitlement to a legacy or share in another estate after a person's death. This guide provides a comprehensive, step-by-step approach to assist users in completing the form accurately and efficiently.

Follow the steps to fill out your Iht 415 form online.

- Click the ‘Get Form’ button to access the Iht 415 form. This will allow you to open it in the editor.

- In the first section, enter the name of the deceased who had a right to a legacy or share, along with their date of death in the specified format (DD MM YYYY). If known, provide their IHT reference number.

- Next, fill in the details about the person who died earlier, referred to as the 'predecessor.' Include their title, surname, and first names. Provide the date the predecessor passed away as well.

- Indicate what the deceased was entitled to from the other estate. Specify whether this was a cash legacy, specific item, or a share of the predecessor's estate.

- If the deceased received any part of their entitlement prior to their death, select 'Yes' and detail what they received. If not, select 'No' and proceed to the next question.

- In the entitlement section, provide comprehensive details about the deceased’s entitlement. This includes listing specific assets and their values at the time of the deceased's demise if applicable.

- If the deceased's entitlement includes houses, land, or a business interest, detail any debts or liabilities associated with these assets.

- Calculate the net value of the entitlement after considering any liabilities or unpaid legacies. Enter this information in the designated fields.

- Proceed to list any other assets the deceased was entitled to, not previously mentioned. Again, ensure to account for any associated debts.

- Finally, indicate whether the values provided are estimates. Once completed, you have the option to save changes, download, print, or share the form.

Complete your Iht 415 form online today to ensure accurate reporting of any entitlements.

Quick succession relief (QSR) is designed to reduce the burden of Inheritance Tax (IHT) where an estate taxable on death includes assets received within the previous five years under an earlier transfer on which tax was (or becomes) payable.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.