Loading

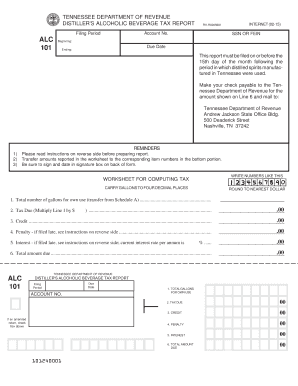

Get Alc 101 Distillers Alcoholic Beverage Return Alc 101 Distillers Alcoholic Beverage Return

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the ALC 101 Distillers Alcoholic Beverage Return online

The ALC 101 Distillers Alcoholic Beverage Return is an essential document for licensed distillers in Tennessee to report and pay the tax on distilled spirits manufactured for their own use. This guide provides comprehensive instructions on how to complete the form accurately and submit it online.

Follow the steps to complete your ALC 101 return efficiently.

- Click ‘Get Form’ button to obtain the ALC 101 Distillers Alcoholic Beverage Return form and access it in the editing interface.

- Account number: Enter your specific account number assigned by the Tennessee Department of Revenue at the top of the form.

- Filing period: Specify the filing period for which you are submitting the return. This indicates the timeframe for the distilled spirits reported.

- SSN or FEIN: Provide your Social Security Number (SSN) or Federal Employer Identification Number (FEIN) in the appropriate section.

- Beginning and ending: Indicate the beginning and ending dates of the reporting period to accurately reflect the timeframe for your returns.

- Total gallons for own use: On the worksheet, report the total number of gallons of distilled spirits for your own use, transferring this amount from Schedule A.

- Tax due: Multiply the amount reported in the previous step by the tax rate of $4.40 per gallon to calculate the tax you owe.

- Credit: If applicable, enter any available credit amount from previous Department of Revenue notices.

- Penalty and interest: If your return is filed late, calculate any penalties and interest according to provided guidelines, ensuring you include these amounts.

- Total amount due: Sum the tax due, penalties, and interest, then subtract any credit to determine the total amount you need to remit.

- Signature: Ensure to sign and date the form where indicated, confirming the accuracy and completeness of your submission.

- Make payment: Prepare a check payable to the Tennessee Department of Revenue for the total amount due, and include it with your mailed return.

- Final steps: Save your changes, and if necessary, download or print a copy of the completed form for your records before submitting.

Complete your ALC 101 Distillers Alcoholic Beverage Return online today to ensure compliance and avoid penalties.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.