Loading

Get Cashiers Check Stop Payment Request And Indemnification

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Cashiers Check Stop Payment Request And Indemnification online

Filling out a Cashiers Check Stop Payment Request And Indemnification online can ensure that you efficiently manage your check-related concerns. This guide provides an easy-to-follow process to complete the necessary form accurately and effectively.

Follow the steps to successfully complete the Cashiers Check Stop Payment Request And Indemnification.

- Press the 'Get Form' button to access the Cashiers Check Stop Payment Request And Indemnification form and open it in your preferred online editing tool.

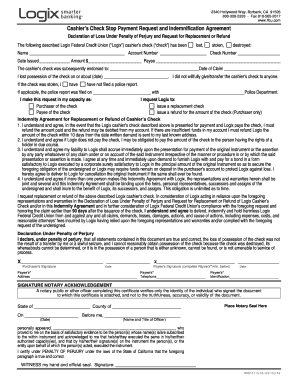

- Begin by entering your name in the designated field, followed by your account number and the specific check number you are addressing.

- In the next section, provide the date when the cashier's check was issued and the amount of the check. Ensure accuracy to prevent delays in processing your request.

- Identify the payee of the check by filling in their name. If the check has been endorsed to someone else, provide their name and the date of the claim.

- Fill in the date you lost possession of the check. State clearly whether the check was lost, stolen, or destroyed. If it was stolen, indicate if a police report has been filed and, if so, provide the details.

- Select your capacity in making this request by marking either 'purchaser of the check' or 'payee of the check.' This is important for determining the appropriate next steps.

- Choose what action you are requesting from Logix by selecting either 'issue a replacement check' (if you are the purchaser) or 'issue a refund for the amount of the check' (for purchasers only).

- Carefully review the indemnity agreement section. Acknowledge and understand your responsibilities regarding potential claims or demands that may arise from this stop payment request.

- Complete the declaration under penalty of perjury by signing and dating the document. Ensure that any required signatories, such as payees, also provide their signatures and information.

- If necessary, arrange for the document to be notarized, ensuring all notarial requirements are met. This may include the notary's signature, seal, and relevant information about the signing.

- Once all sections are properly filled out, review the entire document for accuracy. You can then save your changes, download the completed form, print it, or share it as needed.

Start filling out the Cashiers Check Stop Payment Request And Indemnification form online today to manage your financial needs efficiently.

The bank deposits those funds and then issues the cashier's check to the designated payee for the amount requested. The check cannot be cashed by anyone but the designated payee and settlement is usually quicker than with a personal check.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.