Loading

Get Withdrawal - Excess Withdrawal Request - Bsgi401kcom

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Withdrawal - Excess Withdrawal Request - Bsgi401kcom online

This guide provides detailed instructions on how to accurately complete the Withdrawal - Excess Withdrawal Request form online. Following these steps will help ensure your request is processed efficiently and correctly.

Follow the steps to complete your Withdrawal - Excess Withdrawal Request form.

- Click ‘Get Form’ button to obtain the form and open it in the editor, allowing you to start the completion process.

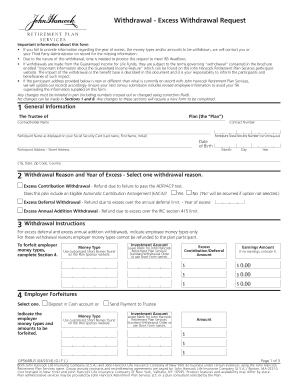

- In the General Information section, fill in the required fields, including the plan name, contractholder name, contract number, participant Social Security number, name, date of birth, and address.

- Move to the Withdrawal Reason and Year of Excess section. Select one withdrawal reason from the options provided and indicate if the plan includes an Eligible Automatic Contribution Arrangement (EACA) by checking 'Yes' or 'No'.

- Complete the Withdrawal Instructions section by identifying employee money types for excess deferral and excess annual addition withdrawals. Note that employer money types cannot be refunded directly to the participant.

- In the Investment Account section, provide the customized short names for the money types and indicate the amounts for excess contributions or deferrals and any earnings. Leave blank if you prefer the standard withdrawal order.

- Fill out the Tax Withholding section to indicate federal and state tax withholding preferences. Specify if you want federal tax withheld and any state withholding instructions if applicable.

- In the Method of Payment section, provide payment instructions, indicating whether you prefer a check, direct deposit, or a wire transfer.

- Complete the Third Party Administrator Withdrawal Fee section if applicable by indicating any fees associated with this withdrawal.

- Lastly, in the Trustee/Authorized Signer Signature section, the authorized individual must sign, print their name, and date the form, certifying the correctness of the information provided.

- Once all sections are completed, save your changes. You can then download, print, or share the form as needed.

Start filling out your Withdrawal - Excess Withdrawal Request form online today to ensure your request is processed promptly.

How to Fix Excess 401(k) Contributions Notify your employer or plan administrator immediately. ... Calculate your excess contributions plus earnings. ... Get an accurate W-2. ... File your return, or an amended return. ... Add the excess contribution to your next return. ... Double-check your contributions going forward.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.