Loading

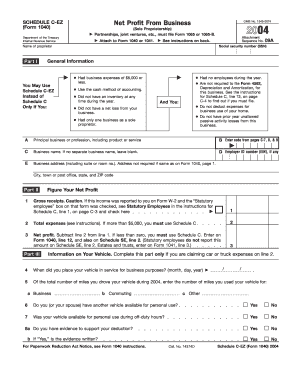

Get 2004 Irs Form 1040 Schedule C-ez - Nd

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2004 IRS Form 1040 Schedule C-EZ online

This guide will walk you through the process of filling out the 2004 IRS Form 1040 Schedule C-EZ online. By following these detailed steps, you can ensure accurate completion of this simplified form for reporting net profit from your sole proprietorship.

Follow the steps to accurately complete Schedule C-EZ online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the name of the proprietor in the designated field. This should be the individual operating the business.

- Fill in your Social Security number (SSN). Ensure this matches your identification documents.

- In Part I, describe your principal business or profession, including the product or service you provide.

- Enter the appropriate six-digit business code from the IRS instructions to classify your business activities.

- If applicable, provide your Employer Identification Number (EIN). If you do not have one, leave this field blank.

- Input the business address where you conducted your activities. If it is the same as your address on Form 1040, this field may be left blank.

- In Part II, enter your gross receipts from your business in line 1. This includes all income received, excluding any losses.

- For line 2, document all deductible business expenses. If your total expenses exceed $5,000, you will need to use the regular Schedule C instead.

- Calculate your net profit by subtracting total expenses from gross receipts in line 3. Report this amount on Form 1040, line 12.

- Complete Part III if you are claiming car or truck expenses. Follow the instructions provided to report the necessary vehicle information.

- After finishing all the entries, review the information for accuracy, then save changes, download, print, or share your completed form accordingly.

Start your digital document journey by completing your forms online today!

Step 1: Gather Information. Business income: You'll need detailed information about the sources of your business income. ... Step 2: Calculate Gross Profit and Income. ... Step 3: Include Your Business Expenses. ... Step 4: Include Other Expenses and Information. ... Step 5: Calculate Your Net Income.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.