Loading

Get Gst03

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Gst03 online

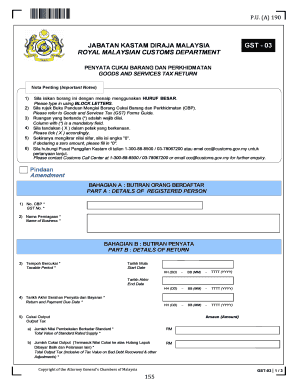

Filling out the Gst03 form is an essential part of reporting goods and services tax. This guide provides clear and comprehensive instructions to help users complete the form accurately and efficiently.

Follow the steps to fill out the Gst03 form correctly.

- Press the ‘Get Form’ button to access the Gst03 form and open it in your preferred editor.

- In Part A, details of the registered person, enter your GST number and name of the business in the designated fields marked with an asterisk (*).

- In Part B, details of return, specify the taxable period by filling in the start and end dates accurately.

- Indicate the return and payment due date in the provided fields. Ensure the format is followed correctly (DD-MM-YYYY).

- Report your output tax in section 5. Include the total value of standard-rated supply and the total output tax in the appropriate fields.

- Proceed to section 6 to provide input tax details, filling out the total value of standard-rate and flat-rate acquisitions.

- Calculate and state the GST amount payable or claimable based on the amounts from sections 5 and 6.

- In section 9, choose whether you plan to carry forward any refund for GST.

- Part C includes additional information. Fill in values for local zero-rated supplies, export supplies, exempt supplies, and other relevant sections.

- Finally, complete Part D by signing and dating the declaration section, confirming the accuracy of the information provided.

- Once you have filled out all required fields, save your changes, download, print, or share the filled form as necessary.

Complete your Gst03 form online today for accurate tax reporting.

Purpose. The Goods and Service Tax Returns program is used to process, print the Goods and Service Tax Returns (GST-03)report and generate the GST Return data file for filing purposes. The GST Return data file is compliant to the Royal Malaysian Customs Department's specification for submission.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.