Loading

Get Cp277

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Cp277 online

Filling out the Cp277 form online can be a straightforward process when approached step by step. This guide is designed to help you navigate through each component of the form with ease and clarity.

Follow the steps to accurately complete the Cp277 form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

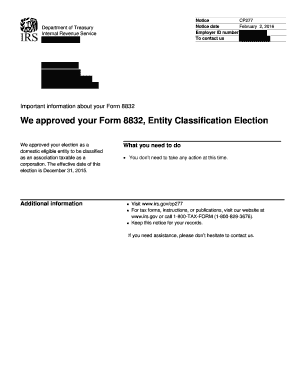

- Start by reviewing the notice date, which is located at the top of the form. Make sure you record this date for your reference.

- Locate your Employer ID number. This unique identifier is essential for your records.

- Read the information about your Form 8832 carefully, particularly regarding your approval status. It is important to understand that your election as a domestic eligible entity has been approved.

- Take note of the effective date of your election, which is explicitly stated in the notice. This will be relevant for your future tax filings.

- Review the additional information provided to understand your next steps. As indicated, you do not need to take any action at this time.

- For your records, you should keep this notice in a safe place. This will serve as an important document for future reference.

- After you have completed reviewing the form, you have the option to save your changes, download, print, or share the form as needed.

Get started by filling out your documents online today.

Basic Qualifying Rules To qualify for the EITC, you must: Have worked and earned income under $59,187. Have investment income below $10,300 in the tax year 2022. Have a valid Social Security number by the due date of your 2022 return (including extensions)

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.