Loading

Get Manual Non-form - City Of Tucson

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Manual Non-Form - City Of Tucson online

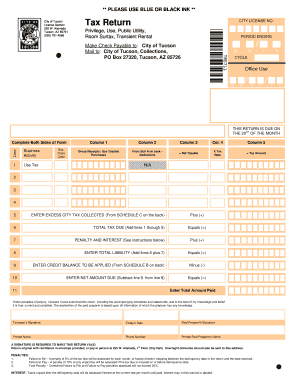

Filling out the Manual Non-Form for the City of Tucson is an essential process for ensuring compliance with local tax regulations. This guide provides clear, step-by-step instructions to assist you in completing the form accurately and efficiently.

Follow the steps to complete the form successfully.

- Click ‘Get Form’ button to obtain the Manual Non-Form and access it in your preferred editor.

- Review the form's sections carefully. Begin with the 'City License No.' field, entering your unique license number if applicable.

- In the 'Period Ending' section, indicate the month and year relevant to the tax return being filed.

- Complete the tax calculation fields under 'Gross Receipts / Use Taxable Purchases' and 'Deductions' using the appropriate amounts from your records.

- Calculate the 'Net Taxable' amount by subtracting the deductions from the gross receipts. Then, multiply the net taxable amount by the applicable tax rate to determine the 'Tax Amount.'

- Enter the 'Excess City Tax Collected' from Schedule C, if applicable, followed by the 'Total Tax Due' which is the sum of all previous calculations.

- If there are penalties or interest due, as stated under 'Penalty and Interest,' calculate these and add them to your total liability.

- Record any credit balance from Schedule B that will be applied to this return.

- Calculate the 'Net Amount Due' by subtracting any credit from your total liability.

- Fill in the 'Total Amount Paid' field, ensuring to review all fields for accuracy.

- Sign the form where indicated as liable for the truthfulness of the information provided. Remember that a signature is required to make the return valid.

- Finally, save any changes made, and download or print the completed form for submission. Make sure to return the original form with any payments in the envelope provided or in person at the designated location.

Start filling out the Manual Non-Form online today to ensure timely compliance with your tax obligations.

Related links form

Illegal or wildcat dumping - For illegal dumping complaints in the City of Tucson, contact the City of Tucson Code Enforcement Department at (520) 791-5843 or visit their website at: City of Tucson Code Enforcement.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.