Loading

Get Op 236 Schedule B

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Op 236 Schedule B online

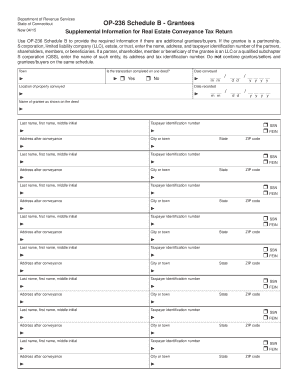

The Op 236 Schedule B is an essential document for reporting additional grantees or buyers in real estate transactions. This guide will provide you with clear, step-by-step instructions on how to complete the form effectively and efficiently online.

Follow the steps to complete the Op 236 Schedule B form.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by indicating whether the transaction is completed on one deed by selecting either 'Yes' or 'No'.

- Enter the location of the property conveyed in the designated field.

- Fill in the date conveyed with the appropriate month, day, and year.

- Provide the date recorded using the correct format for month, day, and year.

- In the section labeled 'Name of grantee as shown on the deed', input the last name, first name, and middle initial for each grantee.

- Enter the taxpayer identification number for each grantee in the designated field.

- Fill in the address after conveyance for each grantee, including the city or town.

- Repeat the previous steps for each additional grantee, ensuring that each individual has their own section filled out accurately.

- Once all fields are completed and reviewed, you can save your changes, download the document, print it, or share it as needed.

Complete your Op 236 Schedule B online today for a smoother real estate transaction process.

Related links form

Tax Credit Relief Connecticut allows taxpayers who pay conveyance tax at the 2.25% rate to claim a property tax credit against their state income tax liability. This credit is based on the amount they paid in conveyance tax at 2.25% rate. Only state residents are eligible for the tax credit under state law.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.