Loading

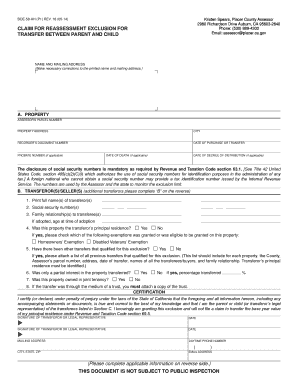

Get Exclusion For Transfer Between Parent And Child - Placer County

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Exclusion For Transfer Between Parent And Child - Placer County online

Filling out the Exclusion For Transfer Between Parent And Child form is an important step in ensuring that property transfers between family members are handled appropriately under California law. This guide provides a clear, step-by-step approach to assist users in completing the form correctly and efficiently.

Follow the steps to complete the form online with ease.

- Click ‘Get Form’ button to access the form and open it in your preferred online editor.

- Provide your name and mailing address, making any necessary corrections to the printed information. Ensure that these details are accurate for communication purposes.

- In section A, enter the property details including the assessor’s parcel number, property address, city, and any applicable dates related to the purchase or transfer.

- In section B, list the transferor(s) or seller(s) information. Provide full names, social security numbers, and the family relationship to the transferee(s). If applicable, indicate whether the property was the principal residence and list any exemptions.

- Answer the questions regarding previous transfers and check if only a partial interest in the property was transferred. If applicable, confirm joint tenancy status.

- Complete the certification section by signing and dating the form, confirming that all information provided is true and correct.

- In section C, provide details for the transferees or buyers in a similar manner as for the transferors, including their relationships and any relevant details.

- Finally, review all sections of the form and ensure all questions are answered completely before saving your changes. Once you are satisfied, you may download, print, or share the completed form as needed.

Take the next step and complete your documents online to ensure a smooth property transfer.

History of the Parent-Child Exclusion Property taxes are imposed whenever there is a “change in ownership.” Under Prop 13, property taxes are imposed at a rate of one percent (1.0%) of the assessed value when the property is transferred, and is in addition to any special assessments that may apply.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.