Loading

Get Sc W-4 - South Carolina Department Of Revenue - State Of South

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SC W-4 - South Carolina Department Of Revenue - State Of South online

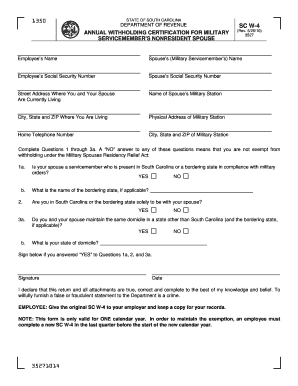

Filling out the SC W-4 form is an essential step for servicemembers' nonresident spouses to claim an exemption from South Carolina withholding tax. This guide provides clear, step-by-step instructions to help you complete the form accurately and efficiently.

Follow the steps to successfully complete the SC W-4 form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter the employee's name in the designated field. This should be the name of the nonresident spouse completing the form.

- Fill in the spouse’s (military servicemember’s) name in the respective field to ensure proper identification.

- Provide the employee's Social Security number. This is necessary for identification and processing purposes.

- Enter the spouse’s Social Security number to link the exemption to the correct servicemember.

- Complete the street address where both you and your spouse currently reside to maintain accurate records.

- Specify the name of your spouse’s military station, as this is critical for verification of military status.

- Fill in the city, state, and ZIP code of your current residence to ensure your living situation is accurately documented.

- Provide the physical address of the military station. This helps validate the servicemember's assigned location.

- Include your home telephone number for any necessary follow-up communications.

- List the city, state, and ZIP code of the military station to confirm the location of your spouse’s service.

- Respond to Questions 1 through 3a regarding exemption eligibility. A 'NO' answer to any question means you are not exempt from withholding under the Military Spouses Residency Relief Act.

- Sign and date the form if you answered 'YES' to Questions 1a, 2, and 3a to certify that the information provided is accurate.

- Once completed, provide the original SC W-4 form to your employer and retain a copy for your records.

- Remember that this form is only valid for one calendar year. Complete a new SC W-4 in the last quarter of the year to maintain the exemption.

Complete your SC W-4 form online today to ensure your withholding status is accurate and up-to-date.

South Carolina has a simplified income tax structure which follows the federal income tax laws. ... Your federal taxable income is the starting point in determining your state income tax liability. Individual income tax rates range from 0% to a top rate of 7% on taxable income.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.