Loading

Get Form 12s - Tax Return For The Year 2014 Tax Return For 2014 For Employees Pensioners Nonproprietary

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Form 12S - Tax Return For The Year 2014 online

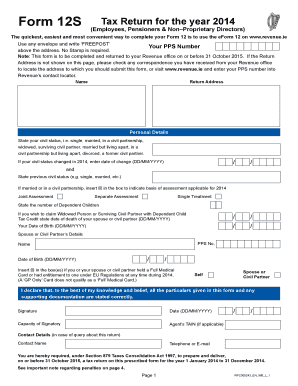

Completing the Form 12S for the year 2014 can be straightforward with the right guidance. This guide offers step-by-step instructions to help users effectively fill out the tax return online.

Follow the steps to accurately complete your Form 12S.

- Click ‘Get Form’ button to obtain the form and open it in the document editor.

- Begin by entering your personal details, including your name, PPS number, and return address. Provide the relevant information about your civil status and dependent children.

- In the section dedicated to your spouse or civil partner, fill in their details, including their PPS number and date of birth. Indicate if they held a Full Medical Card in 2014.

- State your employment or pension income for the year 2014. For each source of income, input the employer or pension company's name followed by the gross pay and the amounts of tax and USC deducted.

- Report any payments received from the Department of Social Protection and other income sources, ensuring to describe the income accurately.

- Claim relevant tax credits, allowances, and reliefs by marking the appropriate boxes, and providing additional descriptions and amounts in the additional information section.

- If applicable, enter your bank details for refunds, ensuring to provide your IBAN and BIC details correctly.

- Review your completed form for accuracy before finalizing. Once satisfied, you can save changes, download, print, or share the completed form.

Complete your Form 12S online today to ensure an accurate tax return.

Related links form

You will owe federal income tax at your regular rate as you receive the money from pension annuities and periodic pension payments. But if you take a direct lump-sum payout from your pension instead, you must pay the total tax due when you file your return for the year you receive the money.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.