Loading

Get Pst Vendor Return Final 142 Web4-3 - Saskatchewan Finance - Finance Gov Sk

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the PST Vendor Return Final 142 Web4-3 - Saskatchewan Finance - Finance Gov Sk online

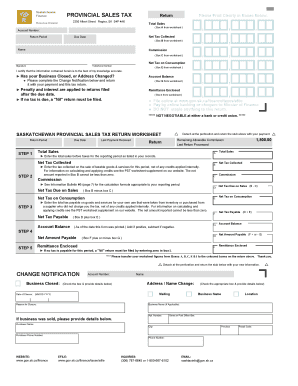

This guide provides a comprehensive overview of how to correctly fill out the PST Vendor Return Final 142 Web4-3 form online. By following these steps, users can ensure accurate completion and submission of the form to meet their tax obligations.

Follow the steps to successfully complete the form online.

- Click the ‘Get Form’ button to access and open the PST Vendor Return Final 142 Web4-3 form in your preferred online editor.

- Begin by entering the total sales amount before taxes for the reporting period in Box A as per your records. Ensure that the entries are clear and accurate.

- In Box B, record the net tax collected on the sale of taxable goods and services for the reporting period. This should reflect any credits applied internally. Remember, the amount reported in Box B must not be less than zero.

- For Box C, calculate the commission based on the formula specified in Information Bulletin #5. This will guide you on how to compute the commission accurately.

- In Box D, determine the net tax due on sales by subtracting Box C from Box B.

- In Box E, indicate the total tax payable for goods and services used from inventory or purchased without being charged tax. Ensure this reflects any credits as well. Again, the amount should not be less than zero.

- In Box F, calculate the net tax payable by adding the values from Box D and Box E.

- If applicable, refer to Box G to update your account balance. Add if the balance is positive, or subtract if negative, as of the date this form was printed.

- In Box H, indicate the net amount payable by adjusting Box F with Box G.

- Finally, in Box I, specify the remittance enclosed. If no tax is due, remember to file a 'Nil' return by entering zero in this box.

- Once all sections are accurately completed, review your entries for correctness, then save your changes, and select the option to download, print, or share the completed form as necessary.

Complete your PST Vendor Return Final 142 Web4-3 form online today to ensure timely submission and compliance.

Provincial Sales Tax (PST) is a six per cent sales tax that applies to taxable goods and services consumed or used in Saskatchewan. It applies to goods and services purchased in the province as well as goods and services imported for consumption or use in Saskatchewan. New and used goods are subject to tax.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.