Loading

Get 2012 Form 4972. Tax On Lump-sum Distributions - Irs

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2012 Form 4972: Tax On Lump-Sum Distributions - IRS online

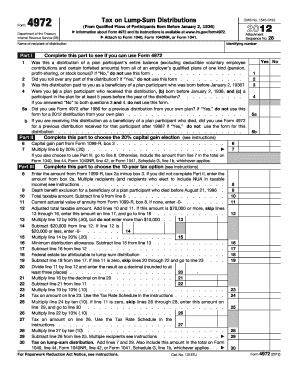

Filling out the 2012 Form 4972 can seem daunting, but with clear, step-by-step guidance, you can complete this tax form with confidence. This guide is designed to help users understand each section and field of the form to ensure accurate and efficient filing.

Follow the steps to successfully complete your 2012 Form 4972.

- Click ‘Get Form’ button to obtain the 2012 Form 4972 and open it for editing.

- At the top of the form, enter the identifying number and name of the recipient of the distribution accurately.

- Complete Part I by answering the qualifying questions regarding the distribution, indicating 'Yes' or 'No' as applicable.

- If applicable, proceed to choose whether you want to make the 20% capital gain election by completing Part II.

- For Part II, enter the capital gain amount from Form 1099-R, box 3, and perform the necessary calculations as instructed.

- If opting for the 10-year tax option, fill out Part III correctly by entering your amounts from Form 1099-R as specified.

- Review all sections for accuracy and completeness before finalizing. Ensure the amounts reported are consistent with Form 1099-R.

- Once completed, you have the option to save changes, download, print, or share the form as required.

Start filling out your 2012 Form 4972 online today for a streamlined filing process.

You'll owe federal income taxes on every monthly pension payment. But with a lump sum, you don't have to pay the tax man if you don't need the money. If you roll the lump sum into an IRA, you'll only be taxed on the money that you choose to take out each month.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.