Loading

Get Health Savings Account Hsa Contribution Instructions - Elements Bb

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Health Savings Account HSA Contribution Instructions - Elements Bb online

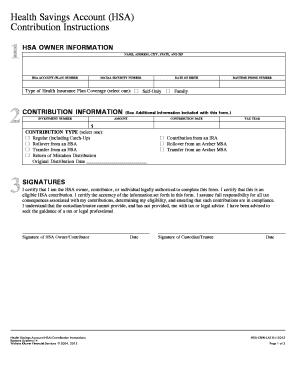

This guide provides a clear and concise overview of how to accurately complete the Health Savings Account (HSA) Contribution Instructions form. Following the step-by-step instructions will help ensure that your contribution is processed correctly.

Follow the steps to complete the form accurately.

- Press the ‘Get Form’ button to download the form and open it in your chosen digital editor.

- Enter your personal information in the HSA owner information section, including your name, address, city, state, and zip code. Ensure that all details are correct to avoid processing delays.

- Input your HSA account (plan) number and your social security number accurately.

- Select your type of health insurance plan coverage by checking either 'Self-Only' or 'Family'. This will determine your contribution limits.

- Complete the contribution information section by filling in your investment number, date of birth, and daytime phone number to enable contact if necessary.

- Enter the amount you wish to contribute in dollars and specify the contribution date and tax year.

- Choose the contribution type from the options provided, such as regular contribution, rollover from another HSA, or transfer from an HSA. Make sure to fill in the original distribution date if you select a rollover or transfer.

- Sign the form certifying that you are the HSA owner or contributor and that the information provided is accurate. Include the date next to your signature.

- If applicable, obtain the signature of the custodian or trustee along with the date.

- Once all fields are completed, save changes before downloading, printing, or sharing the form as necessary.

Complete your Health Savings Account contribution document online today.

The form has a line for reporting your direct contributions to your HSA, and you'll carry that deduction to line 25 of your Form 1040. The form also has a line to report employer contributions, which you'll fill in if you made pretax contributions via payroll deduction or if your company contributed to your account.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.