Loading

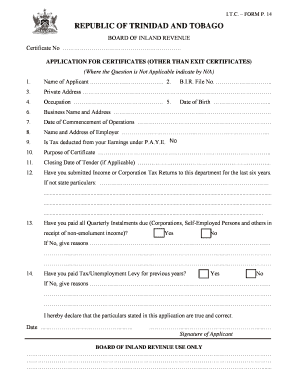

Get Application For Certificates Other Than Exit - Inland Revenue Division

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Application For Certificates Other Than Exit - Inland Revenue Division online

This guide provides a comprehensive overview of how to accurately complete the Application For Certificates Other Than Exit - Inland Revenue Division online. Following these step-by-step instructions will ensure that you fill out the necessary form correctly and efficiently.

Follow the steps to complete the application form successfully.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by filling in the name of the applicant in the designated field. Make sure to provide your full legal name as it appears on official documents.

- Enter your B.I.R. file number. This may be found on previous tax documents that you have received from the Inland Revenue Division.

- Provide your private address in the section allocated for it. Ensure that it is complete and accurate to avoid any communication issues.

- Specify your occupation. This should be your current job title or the main activity you are engaged in.

- In the business name and address section, enter the name and location of your business if applicable. If you do not have a business, you may leave this blank.

- Indicate the date of commencement of operations for your business or profession. If this does not apply, you may write 'N/A'.

- Provide the name and address of your employer if you are currently employed.

- State whether tax is deducted from your earnings under P.A.Y.E. by selecting 'Yes' or 'No'. If 'No', additional details may be required.

- Clearly state the purpose of the certificate. This might relate to a specific requirement you are addressing with the Inland Revenue Division.

- If applicable, indicate the closing date of the tender related to this application.

- Answer whether you have submitted income or corporation tax returns to the department for the last six years. If not, provide relevant particulars.

- Confirm whether you have paid all quarterly installments due as indicated in the form. If not, explain the reasons for any delays or missed payments.

- Indicate if you have paid the tax/unemployment levy for previous years. If not, provide the reasons.

- Review all entries for accuracy. Ensure that the information you provided is true and correct. After that, sign the application and date it.

- Finally, save the completed form, and if necessary, download, print, or share it as required.

Complete your application for certificates online today to ensure a smooth processing experience.

A compliance check is a review of information forms that the IRS requires taxpayer to file or maintain; for example, 940s, 941s, W-2s, 1099s, or W-4s. During a compliance check, the IRS may ask taxpayers whether they understand or have questions about the filing requirements for these forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.