Loading

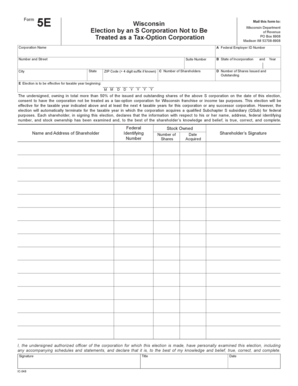

Get 2015 Ic-048 Form 5e Wisconsin Election By An S - Revenue Wi

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2015 IC-048 Form 5E Wisconsin Election By An S - Revenue Wi online

Filling out the 2015 IC-048 Form 5E is an essential step for corporations that wish to elect not to be treated as a tax-option corporation for Wisconsin tax purposes. This guide provides clear, step-by-step instructions to help users effectively complete the form online with confidence.

Follow the steps to accurately complete the form online.

- Click the ‘Get Form’ button to obtain the form and access it in the designated online environment.

- Enter the corporation's name and complete the address fields, including the street number, suite number (if applicable), city, state, and ZIP code.

- Provide the federal employer identification number for the corporation in the designated field.

- Indicate the number of shareholders in the 'C Number of Shareholders' field.

- Fill in the state of incorporation and the year under the specified fields.

- Record the number of shares issued and outstanding in the corresponding field.

- Specify the effective date for the election in the MM/DD/YYYY format as required.

- List the names, addresses, and federal identifying numbers of each shareholder consenting to the election. Include the number of shares owned and the date acquired for each shareholder.

- Obtain signatures from all shareholders listed, confirming their consent. If applicable, ensure that both partners sign if the stock is held as community property.

- An authorized officer of the corporation must sign the form in the provided space, affirming the accuracy of the information.

- Review all entries for completeness and accuracy. If additional space is needed, attach a schedule with the required information.

- Save your changes, then choose to download, print, or share the completed form as necessary.

Begin your online filing of the 2015 IC-048 Form 5E today to ensure compliance with Wisconsin tax regulations.

The following persons are eligible to file as S corporation shareholders: U.S. citizens. Permanent residents. Qualified subchapter S trusts.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.