Loading

Get Av-9 2016 - Department Of Revenue

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the AV-9 2016 - Department Of Revenue online

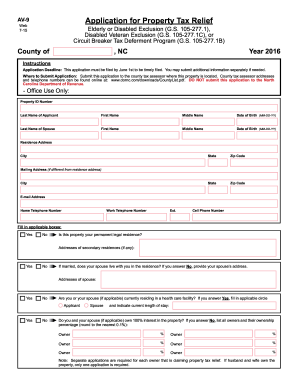

Filling out the AV-9 2016 form for property tax relief is an important step for eligible property owners, including elderly and disabled individuals. This guide provides detailed steps to help users complete the application accurately and efficiently online.

Follow the steps to fill out the AV-9 2016 form with ease.

- Press the ‘Get Form’ button to access the AV-9 2016 application and open it in your preferred document management tool.

- Complete the personal information section, including the applicant's name, date of birth, and contact information. Ensure that you provide an accurate mailing address if it differs from your residence address.

- Indicate if the property serves as your permanent legal residence by selecting 'Yes' or 'No.' If applicable, also provide your spouse's details as outlined.

- Select the appropriate program you are applying for by filling in the corresponding circles for the Elderly or Disabled Exclusion, Disabled Veteran Exclusion, or Circuit Breaker Tax Deferment Program.

- If applying for the Elderly or Disabled Exclusion, verify whether you or your spouse meet the age or disability requirements and complete Parts 5 and 6 as required.

- For the Disabled Veteran Exclusion, confirm your eligibility criteria, and ensure to file Form NCDVA-9 if applicable.

- If applying for the Circuit Breaker Property Tax Deferment, confirm your age or disability and complete the required sections with ownership proof.

- Fill in the income information for both the applicant and spouse as required, attaching necessary tax documentation.

- Complete Part 6 with your affirmation and signatures, making sure to indicate the date to validate your application.

- Review the completed application for accuracy, then save your changes. You can then download, print, or share the form as needed.

Take the first step towards securing property tax relief by filling out your AV-9 2016 application online today.

An ad valorem tax is a property tax based on the assessed value of the property, which may or may not be equivalent to its market value. Appraised Value. Also known as “market value”. This is the value before any exemptions or deferrals are applied.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.