Loading

Get Av-63 Power Of Attorney Of Business Entities And Declaration Of ... - Dor State Nc

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the AV-63 Power Of Attorney Of Business Entities And Declaration Of Nonattorney Representative online

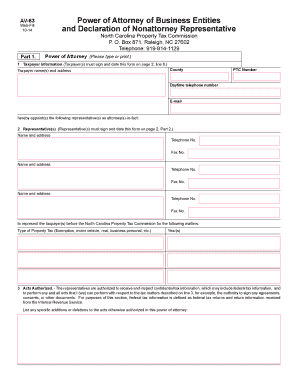

Filling out the AV-63 Power Of Attorney Of Business Entities and Declaration Of Nonattorney Representative is an essential process for ensuring that your chosen representative can act on your behalf regarding property tax matters in North Carolina. This guide will provide you with a step-by-step approach to efficiently complete the form online.

Follow the steps to complete the form accurately and efficiently.

- Click the ‘Get Form’ button to retrieve the AV-63 Power Of Attorney form and open it for editing.

- Begin by entering the taxpayer information in Part 1. This includes the taxpayer name(s), address, county, property tax commission number, daytime telephone number, and email address. Ensure that all information is accurate and complete.

- Next, designate your representative(s) in the designated section. Provide each representative's name, address, telephone number, and fax number. Be sure that each representative is aware of this role.

- Indicate the type of property tax matters for which the representatives will act on your behalf. Specify the tax years or periods applicable to this authorization.

- In the 'Acts Authorized' section, affirm the acts that your representatives are authorized to perform. If there are any specific additions or modifications, list them accordingly.

- If you do not wish to revoke any prior powers of attorney for the same matters and periods, ensure that the relevant box is checked and attach copies of any previous documents to remain in effect.

- For signature collection, each taxpayer must sign and date the form on page 2. Include any applicable titles. Make sure to complete all required fields, or the form may be returned.

- If using a notary public, include their signature and printed name in the designated area to validate the signatures provided on the form.

- Finally, for Part 2 regarding the Declaration of Nonattorney Representative, have the representative sign and date as necessary. Verify that the declaration is complete to avoid any processing delays.

- Once all sections are filled out, review the form for accuracy, making any necessary corrections. Then, save your changes, download a copy, print it for your records, or share it with necessary parties.

Begin your online filling process now to ensure timely and accurate representation for your property tax matters.

This document provides information to taxpayers for completing the GEN-58 which grants authority to an individual to represent a taxpayer before the Department of Revenue and to receive and inspect confidential tax information, which may include federal tax information.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.