Loading

Get Salary Redirection Agreement

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Salary Redirection Agreement online

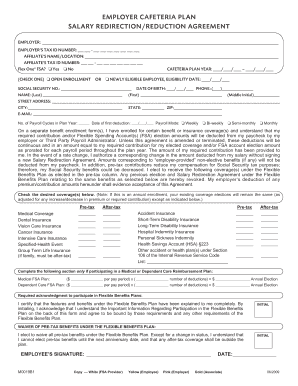

Filling out the Salary Redirection Agreement online is a crucial step in managing your flexible benefits and ensuring your contributions are accurately redirected. This guide will provide you with detailed, step-by-step instructions to complete the form efficiently.

Follow the steps to complete your Salary Redirection Agreement online.

- Click the ‘Get Form’ button to access the Salary Redirection Agreement and open it in the relevant editing interface.

- Fill in the employer's information, including the employer's name and tax identification number. Ensure accuracy to avoid potential delays.

- Provide the affiliate's name and tax ID number, following the same attention to detail as for the employer's information.

- Indicate if you will be enrolling in the Flex One® FSA. Select 'Yes' or 'No' as applicable.

- Enter the cafeteria plan year dates. This will denote the start and end of your enrollment period.

- Choose the appropriate option for your enrollment situation: 'Open Enrollment' or 'Newly Eligible Employee,' and fill in your eligibility date if relevant.

- Input your Social Security number and full name as prompted, including your last, first, and middle initial.

- Provide your date of birth, phone number, street address, city, state, and ZIP code.

- Enter your email address to ensure communication regarding your benefits and agreements.

- Specify the number of payroll cycles in the plan year and indicate the date of the first deduction.

- Select the payroll mode that applies to you, choosing from weekly, bi-weekly, semi-monthly, or monthly.

- On a separate benefit enrollment form, confirm your chosen benefits and insurance coverages. Ensure to review and understand the contributions that will be deducted from your paycheck.

- Mark the desired coverages (medical, dental, vision, etc.) and specify if they are pre-tax or after-tax.

- If applicable, fill out the Medical and Dependent Care FSA section with the amounts per pay period and the total annual election.

- Provide your initials to acknowledge that the features and benefits of the Flexible Benefits Plan have been explained to you.

- If you choose to waive pre-tax benefits, check the appropriate box and understand the implications of your choice.

- Sign the document to confirm your agreement to the terms and conditions outlined in the Salary Redirection Agreement.

- Finally, ensure you save any changes made, and have the option to download, print, or share the completed agreement as necessary.

Complete your Salary Redirection Agreement online today to manage your benefits effectively.

Employer contributions to the cafeteria plan are usually made pursuant to salary reduction agreements between the employer and the employee in which the employee agrees to contribute a portion of his or her salary on a pre-tax basis to pay for the qualified benefits.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.