Loading

Get Erappa Expense Form - Erappa

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the ERAPPA Expense Form - Erappa online

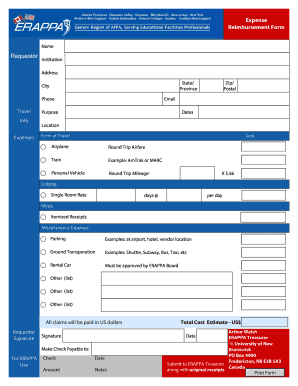

This guide provides detailed instructions on filling out the ERAPPA Expense Form - Erappa online, ensuring that users can navigate the process with ease and confidence. By following these steps, you will ensure that your expense claims are completed accurately and efficiently.

Follow the steps to complete the ERAPPA Expense Form effectively.

- Press the ‘Get Form’ button to access the ERAPPA Expense Form and open it in your preferred online editor.

- Begin by filling in your personal information. Include your full name, the institution you represent, your address (including state/province and zip/postal code), and contact details such as your phone number and email.

- Indicate the purpose of your travel by providing a brief description. Specify the travel dates, location, and the form of travel you will utilize.

- Under the ‘Expenses’ section, fill in the different expense categories. For airfare, specify the round-trip cost and the mode of transportation used, whether it be an airplane, train, or personal vehicle, calculating mileage based on the standard rate.

- For lodging, indicate the single room rate per day and the total number of days you will be staying.

- List meals by providing itemized receipts, and indicate any miscellaneous expenses such as parking or ground transportation.

- If using a rental car, confirm that you have obtained approval from the ERAPPA Board and enter the related expenses.

- Once all fields are completed accurately, review your entries for any errors. After verifying that all information is correct, you may choose to save your changes.

- Finally, download, print, or share the completed form, remembering to include original receipts before submitting it to the ERAPPA Treasurer.

Start completing your ERAPPA Expense Form online today.

What Is An Expense Reimbursement? The expense must be for deductible business expenses that are paid or incurred by an employee in the course of performing services for your organization. The employee must be required to substantiate the amount, time, use, and business purpose of the reimbursed expenses.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.