Loading

Get Request For Wage Adjustment - Dllr Maryland

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Request For Wage Adjustment - Dllr Maryland online

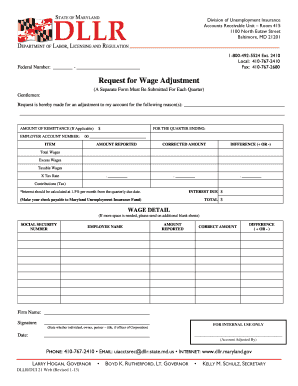

This guide provides comprehensive instructions for filling out the Request For Wage Adjustment form for Maryland's Division of Unemployment Insurance. Whether you are seeking an adjustment for overreported wages or other discrepancies, this step-by-step approach will help you navigate the online form with ease.

Follow the steps to complete your Request For Wage Adjustment successfully.

- Click ‘Get Form’ button to obtain the form and open it in your chosen editing tool.

- Begin by filling out your federal number at the top of the form. This is essential for identification and processing of your request.

- Indicate the reason for your wage adjustment in the provided space. Be as specific as possible to ensure clarity.

- Next, input the amount of remittance, if applicable, along with the relevant employer account number.

- For the quarter ending, specify the date related to the adjustment you are requesting.

- In the itemized section, report the amounts as follows: enter the amounts reported, corrected amounts, and the difference for total wages, excess wages, and taxable wages.

- Calculate and fill in the tax rate and contributions based on the corrected amounts. Note that interest should be calculated at 1.5% per month from the quarterly due date.

- Afterward, indicate the total amount owed, including any interest, and make sure this is clearly stated.

- In the wage detail section, provide information for each employee affected by this adjustment, including their social security number, name, and any discrepancies.

- Provide the firm name and signature at the bottom of the form as required. Ensure that you specify your title if you are an owner, partner, or officer of the corporation.

- Once you have completed filling out the form, review all entries for accuracy. Save your changes and proceed to download, print if necessary, or share the form as required.

Complete your request for wage adjustment online today to ensure timely processing of your application.

Related links form

If you believe this information is incorrect, you can file a dispute by the deadline noted on the overpayment correspondence. Claimants can also contact the Benefit Payment Control Unit by calling 410-767-2404. You can also send an email ui.overpaymentinquiry@maryland.gov or complete the online inquiry form here.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.