Loading

Get Iracmbconlaz Ira Cont Instructions For Trad Roth And Simple Iras

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRACMBCONLAZ IRA contribution instructions for traditional, Roth, and SIMPLE IRAs online

Filling out the IRACMBCONLAZ IRA contribution instructions form is essential for documenting contributions to traditional, Roth, or SIMPLE IRAs. This guide will provide step-by-step instructions to assist users in completing the form accurately and efficiently online.

Follow the steps to complete the IRA contribution instructions form online.

- Click the 'Get Form' button to access the IRA contribution instructions form and open it in your preferred document editor.

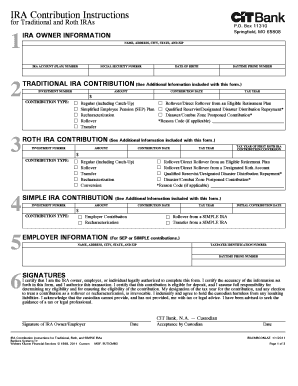

- Enter your personal information in the IRA owner information section, including your name, address, city, state, ZIP code, account number, social security number, date of birth, and daytime phone number.

- Fill out the traditional IRA contribution section. Provide the investment number, contribution amount, contribution date, tax year, and select the appropriate contribution type from the options provided.

- Complete the Roth IRA contribution section by entering the investment number, contribution amount, contribution date, tax year of the first Roth IRA contribution, and choose the relevant contribution type.

- If applicable, fill in the SIMPLE IRA contribution section. Include the investment number, contribution amount, contribution date, initial contribution date, and the contribution type.

- Complete the employer information portion, filling in the name, address, taxpayer identification number, and phone number as required.

- Sign and date the form in the signatures section, certifying your status as the IRA owner, employer, or authorized individual responsible for the information provided.

- After completing all sections, review the form for accuracy and ensure all required fields are filled out. Save your changes, and choose to download, print, or share the completed form as needed.

Begin your document completion process online now to ensure all contributions are properly documented.

Although you are able to make both traditional or Roth IRA and Simple IRA Contributions in the same year, the amount you can contribute varies depending upon your age, the type of IRA you have and limits set forth by the IRS.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.