Loading

Get 2015 Early Achp Replacement Rebate Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the 2015 Early AC/HP Replacement Rebate Form online

Filling out the 2015 Early AC/HP Replacement Rebate Form online can be a straightforward process when you understand each component. This guide provides step-by-step instructions to help users accurately complete the form and submit it to receive their rebate.

Follow the steps to fill out the form correctly

- Click ‘Get Form’ button to obtain the form and open it in your preferred online editor.

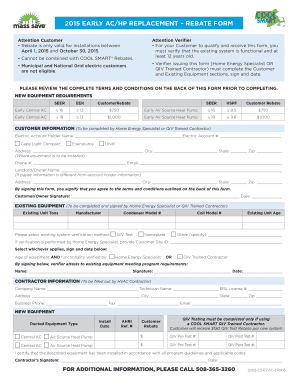

- Begin by filling out the customer information section. Enter the electric account holder's name, electric account number, address, city, state, zip code, phone number, and email. If the payee information differs from the account holder, include the landlord or owner's details in the provided fields.

- In the existing equipment section, complete the information about the existing system, including the manufacturer, model numbers, and verification method. Specify the age of the existing unit and confirm its functionality and age through the authorized verifier.

- Next, move to the contractor information section. Input the company name, technician name, EPA license number, address, city, state, zip code, business phone, fax, and email.

- Fill out the new equipment section by entering the ducted equipment type, installation date, AHRI reference number, and the customer rebate amount. Ensure that you verify the requirements met for QIV testing if applicable.

- Review the entire document carefully for accuracy. Ensure that all signatures are included where necessary, including the customer/owner signature and the verifier's signature.

- Finally, save your changes. You may then download, print, or share the completed form as necessary. Ensure that you retain copies of your submission for your records.

Start filling out your documents online today to secure your rebate.

ENERGY STAR® Tax Credits Ohio homeowners can currently claim tax credits equal to 30% of installation costs for the highest efficiency tier products: Heat pumps: Up to $2,000 for ENERGY STAR® Certified heat pump HVAC systems. Gas furnaces: Up to $600 for installing a new ENERGY STAR® Certified furnace system.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.