Loading

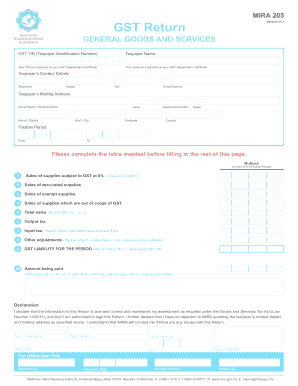

Get Mira 205 Gst Return - General Gst (english)(version 14.1)

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MIRA 205 GST Return - General GST (English)(Version 14.1) online

This guide provides a comprehensive and user-friendly approach to completing the MIRA 205 GST Return. It is designed for users of all experience levels to navigate the process smoothly and efficiently.

Follow the steps to complete your GST return accurately.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Enter your GST TIN (Taxpayer Identification Number) as it appears on your GST Registration Certificate.

- Provide your name exactly as it appears on your GST Registration Certificate.

- Fill in your contact details, including mobile number, telephone number, email address, and fax number.

- Input your mailing address, detailing house name/building name, island/district, level, atoll/city, apartment number, postcode, street, and country.

- Indicate the taxable period by entering the start and end dates in the specified format (DD/MM/YYYY).

- Complete the sales table on the reverse side, detailing sales of supplies subject to GST at 6%, zero-rated supplies, exempt supplies, and out-of-scope supplies.

- Calculate the total sales, output tax, input tax, and other adjustments required. Make sure to attach necessary documents for input tax and adjustments.

- Determine your GST liability for the period by applying the formula (Output tax minus Input tax plus/minus Other adjustments).

- State the amount being paid as indicated, and provide explanations if there are discrepancies between the GST liability and payment amount.

- Review the declaration section, ensuring all information is accurate, then sign and date it, indicating your title and designation.

- After verifying all fields, save your changes, and choose to download, print, or share the completed form as needed.

Complete your MIRA 205 GST Return online today for efficient tax management.

Data is stored in a table in the form of rows and columns. Each row represents an individual entity in the set of entities the table represents. For example, in a student information system database, you are going to have a students table. Each row in the students table will represent an individual student.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.