Loading

Get Certificate Of Fa Costs - Cost Allocation Services

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Certificate Of FA Costs - Cost Allocation Services online

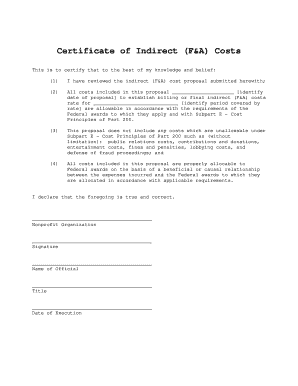

Filling out the Certificate Of FA Costs - Cost Allocation Services form is an essential process for compliance with federal funding requirements. This guide will walk you through each section of the form, ensuring that you can submit your information accurately and efficiently.

Follow the steps to complete your form with ease.

- Click ‘Get Form’ button to access the form and open it in your preferred editing tool.

- Review the first section carefully, where you will certify that you have reviewed the indirect cost proposal. Ensure that you identify the date of the proposal correctly.

- In the second field, specify the period covered by the indirect cost rate. This information is crucial as it establishes the timeframe for which the costs are being allocated.

- Confirm that all costs included in the proposal are allowable under the applicable federal requirements. Familiarize yourself with Subpart E – Cost Principles of Part 200 to ensure compliance.

- In the next section, verify that no unallowable costs were included in your proposal. This may include items such as public relations costs or lobbying costs, which you should explicitly list out.

- Next, ensuring all included costs are allocable to the federal awards is necessary. This means those costs need to reflect a beneficial or causal relationship with the federal awards.

- Once all sections are completed, provide the required organizational details, including the nonprofit organization's name, the signature of the official, their printed name, title, and the date of execution.

- Finally, review the completed form for accuracy and completeness. After verifying all information, you can save your changes, download the document, print it, or share it as needed.

Start completing your Certificate Of FA Costs - Cost Allocation Services form online today!

An indirect cost rate is simply a device for determining fairly and expeditiously the proportion of general (non-direct) expenses that each project will bear. It is the ratio between the total indirect costs of an applicant and some equitable direct cost base.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.