Loading

Get Calcasieu Parish Sales Tax Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Calcasieu Parish Sales Tax Form online

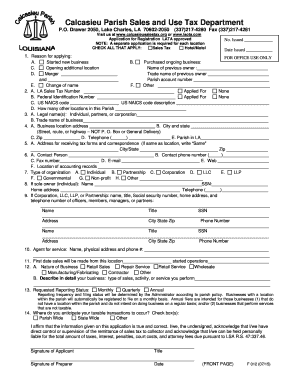

Completing the Calcasieu Parish Sales Tax Form is a crucial step for those engaging in retail activities within the parish. This guide provides a clear, step-by-step approach to help users fill out the form easily and accurately.

Follow the steps to effectively complete your sales tax registration form.

- Click ‘Get Form’ button to obtain the Calcasieu Parish Sales Tax Form and open it for editing.

- Begin with the 'Reason for applying' section by marking the appropriate box. This could include starting a new business, purchasing an ongoing business, or opening an additional location.

- Provide the necessary identification numbers in Section A, B, and C. Ensure that the LA Sales Tax Number or Federal Identification Number is accurately entered.

- In the Business Location Address section, fill in the physical address where your business operates. Be sure to include the street, city, state, and zip code.

- Complete the mailing address section if it is different from the business location. If it is the same, simply write 'Same'.

- Designate a contact person responsible for communication regarding your sales tax registration. Include their phone number, fax number, email, and web address of the business.

- Indicate the type of organization by checking the corresponding box that describes your business structure, such as individual, partnership, corporation, etc.

- Complete the nature of your business section, selecting the appropriate category and providing a detailed description of business activities.

- In the Requested Reporting Status section, select your preferred frequency of filing: monthly, quarterly, or annually.

- Review all sections for accuracy and complete the signature section, which requires the applicant's signature along with the date. If someone else prepared the application, their signature is also required.

- Save your changes, then download, print, or share the completed form as needed. Ensure the finished application is mailed to the specified address.

Ensure you complete your documents online to streamline your registration process and comply with Calcasieu Parish tax requirements.

The minimum combined 2020 sales tax rate for Calcasieu Parish, Louisiana is 10.2%. This is the total of state and parish sales tax rates. The Louisiana state sales tax rate is currently 4.45%. The Calcasieu Parish sales tax rate is 0%.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.