Loading

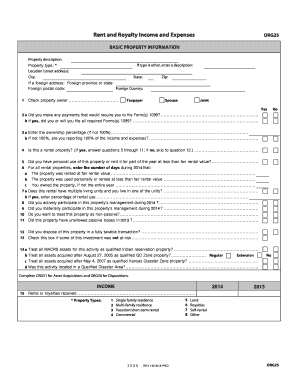

Get Rent And Royalty Income And Expenses Org25 Basic Property Information Property Description: If Type

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Rent And Royalty Income And Expenses ORG25 BASIC PROPERTY INFORMATION Property Description: If Type online

The Rent and Royalty Income and Expenses ORG25 form is essential for individuals managing rental properties. This guide provides clear instructions on filling out crucial sections of the form efficiently, facilitating accurate reporting of income and expenses.

Follow the steps to fill out your Rent and Royalty Income and Expenses form.

- Press the ‘Get Form’ button to obtain the form and open it in the editor.

- Begin by filling out the basic property information, including the property description and type. If the type is 'other,' provide a suitable description.

- Next, input the property location by detailing the street address, city, state, and zip code. If applicable, fill in the foreign address details, including province or state, country, and postal code.

- Indicate whether you are the property owner and select the corresponding option: taxpayer, spouse, or joint owner.

- Answer the questions regarding payments subject to Form 1099. Confirm if you made payments requiring this form and whether you have filed all necessary 1099 forms.

- Enter the ownership percentage if it is less than 100%. Specify if you are reporting 100% of the income and expenses.

- Determine if the property is a rental property. If it is, proceed to answer additional questions regarding personal use and rental duration.

- Complete the questions about rental property management participation, including details on any personal use of the property.

- Assess if you wish to treat the property as non-passive, and provide information about any unallowed passive losses from the previous year.

- If applicable, check boxes regarding taxable transactions, at-risk conditions, MACRS assets, and qualified disaster areas.

- Fill in the income section, documenting rents or royalties received from previous years.

- Proceed to the expenses section and list out all qualifying expenses related to the property, ensuring accurate records for each item.

- Finalize the form by reviewing all entered information. You can then save changes, download, print, or share the completed form as needed.

Complete your Rent and Royalty Income and Expenses form online to ensure accurate reporting today.

File Form 1099-MISC for each person to whom you have paid during the year: At least $10 in royalties or broker payments in lieu of dividends or tax-exempt interest. At least $600 in: Rents.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.