Loading

Get Policy And Guidelines Of The Small Debt Resolution Scheme

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Policy And Guidelines Of The Small Debt Resolution Scheme online

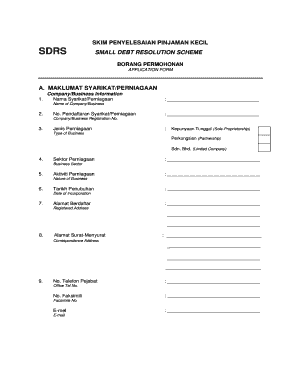

This guide provides clear and supportive instructions on how to complete the Policy And Guidelines Of The Small Debt Resolution Scheme application form online. Whether you are familiar with such forms or new to the process, this step-by-step approach will help you navigate through each section effectively.

Follow the steps to successfully complete your application form

- Click 'Get Form' button to obtain the form and open it in your preferred document editor.

- Begin with Section A, which is focused on company or business information. Fill in the name of your company or business and ensure to provide the registration number accurately.

- Continue by specifying the type of business, selecting from sole proprietorship, partnership, or limited company. Also, indicate the business sector and the nature of your business.

- In the following fields, provide the date of incorporation, registered address, correspondence address, office telephone number, facsimile number, and email address.

- List the names of directors or owners, providing for each individual their new and old identification card numbers.

- Detail the shareholders' information, including the total shareholding amount and percentage ownership for each shareholder.

- Indicate the paid-up capital of your business. This figure should reflect the actual financial investment made into the company.

- Provide the contact information for an individual who can be reached for additional questions, including their role within the company and both office and mobile phone numbers.

- Move on to Section B, where you will disclose creditors' information. List all financial institutions you have borrowing agreements with, including the type of facilities, approved loan amounts, and outstanding balances.

- If there are any legal actions against your company or its directors, provide relevant details in the specified section, including the nature of the action and any proposed settlements.

- Complete Section C by stating the reasons for any inability to repay loans as scheduled, outlining your business difficulties, and describing measures taken to address these issues.

- In the same section, describe future plans for business recovery, including steps and timelines that you intend to follow.

- If necessary, fill out Section D, specifying any additional financing needs, the type of financing required, and purposes for needing that financing.

- Lastly, complete the consent section by certifying that all provided information is true and correct. Have the authorized signatory include their name, designation, date, and company chop.

- After completing the form, ensure to save your changes, and download or print a copy for your records before sharing it as required.

Ready to complete your application? Start filling out your documents online today.

The Special Drawing Right (SDR) allocation is not a loan from the IMF. When the IMF allocates SDRs, participants in the SDR Department receive unconditional liquidity represented by an interest-bearing reserve asset (SDR holding) and a corresponding long-term liability to the SDR Department (SDR allocation).

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.