Loading

Get Retirement Service Credit Payment Form - New York State Deferred

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Retirement Service Credit Payment Form - New York State Deferred online

This guide provides detailed instructions on how to complete the Retirement Service Credit Payment Form for the New York State Deferred Compensation Plan. Following these steps will help ensure that you fill out the form correctly and submit it on time.

Follow the steps to complete the Retirement Service Credit Payment Form efficiently.

- Click ‘Get Form’ button to obtain the form and open it in your preferred editor.

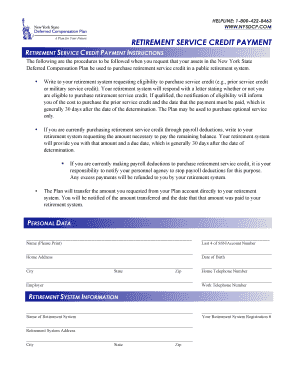

- Fill in your personal data, including your name, last four digits of your Social Security Number or account number, home address, date of birth, city, state, zip code, home telephone number, employer, and work telephone number.

- Provide the necessary retirement system information by including the name and address of the retirement system, city, state, zip, and your registration number with the retirement system.

- Under the payment method section, enter the amount you wish to transfer, specify the retirement system to which the funds will be sent, and clearly indicate the payment due date.

- Complete the authorization section by signing the form and dating it. This confirms your request to transfer the specified funds for the purchase of prior service credit.

- Include any required documents, such as a copy of the notification or letter of eligibility from your retirement system and any receipts for mandatory payments, if applicable.

- Return the completed form along with the documents to the New York State Deferred Compensation Plan, ensuring it is received at least 15 days before the payment due date. You may also choose to fax the documents to the provided fax number.

- After submitting, monitor for confirmation of the transfer and retention of your required paperwork for your records.

Start filling out your Retirement Service Credit Payment Form online today to ensure timely submission.

A deferred compensation plan withholds a portion of an employee's pay until a specified date, usually retirement. The lump-sum owed to an employee in this type of plan is paid out on that date. Examples of deferred compensation plans include pensions, retirement plans, and employee stock options.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.