Loading

Get Form 11 Withdrawal From Lira Or Lif - Government Of Nova Scotia

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the Form 11 Withdrawal From LIRA Or LIF - Government Of Nova Scotia online

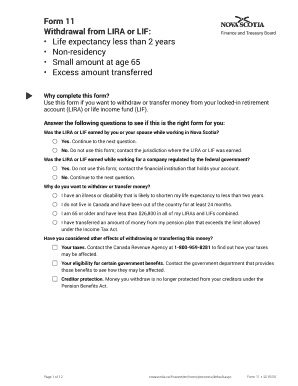

This guide is designed to assist you in completing the Form 11 Withdrawal From LIRA or LIF online. Understanding the process and the specific requirements of the form will ensure a smoother experience as you navigate your options for withdrawing or transferring funds from your locked-in retirement account or life income fund.

Follow the steps to complete your application effectively.

- Press the ‘Get Form’ button to obtain the form and open it in your document editor, ensuring you have the latest version to complete your application accurately.

- Provide your personal information in the designated fields. This includes your last name, first name, middle name, address, postal code, phone number, and date of birth.

- Fill in information regarding your LIRA or LIF. Include the account number, name of the financial institution managing the account, and their address and postal code.

- Indicate where the money in your LIRA or LIF was transferred from by selecting the appropriate option regarding your pension plan circumstances.

- Specify the company name and province where the pension was earned for both you and any former spouses, if applicable.

- Attach a copy of the most recent statement from your LIRA or LIF. This documentation supports your application and demonstrates the current balance.

- Complete the necessary declaration based on the reason for your withdrawal, referencing the appropriate supporting documents as required.

- If applicable, provide an Owner’s Certificate for the LIRA or LIF. Ensure it is signed and witnessed according to the guidelines listed on the form.

- If married or in a common-law relationship, attach a Spouse’s Consent to the withdrawal or transfer. This document must be also signed and witnessed.

- Review all entered information carefully for accuracy. Save your changes, download, print, or share the form as necessary before submitting it to the appropriate financial institution.

Complete your Form 11 Withdrawal From LIRA Or LIF online today to ensure a seamless transition for your finances.

A LIF is used to convert LIRA money to income just like a RRIF is used to convert RRSPs to income. Just like the LIRA has similarities to the RRSP, the LIF has a lot of similarities to the RRIF. ... In both cases, there is a minimum income that must come out of then plan.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.