Loading

Get Skv 4632

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Skv 4632 online

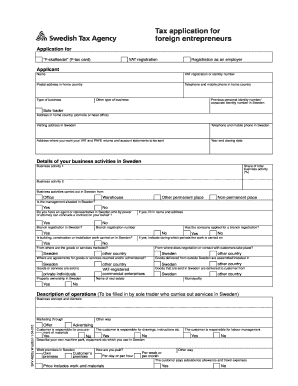

Filling out the Skv 4632 form is a crucial step for foreign entrepreneurs seeking to establish their business in Sweden. This guide provides a clear, step-by-step approach to help you navigate the online form with ease.

Follow the steps to complete the Skv 4632 online efficiently.

- Press the ‘Get Form’ button to access the form and open it for completion.

- Begin by entering your name and any relevant VAT registration or identity number in the designated fields.

- Provide your postal address in your home country, along with your telephone and mobile phone numbers in that country.

- Indicate the type of business you are conducting and include your previous personal identity number or corporate identity number in Sweden, if applicable.

- Fill in the address of your domicile or head office in your home country, as well as your visiting address in Sweden.

- Specify the address where you want your VAT and PAYE returns sent along with your accounting statements.

- Provide your year-end closing date and details regarding your business activities in Sweden, including the percentage share of each business activity.

- Answer whether the management is situated in Sweden and if you have an agent or representative in Sweden who can act on your behalf.

- Indicate if your company has applied for branch registration in Sweden, and provide the branch registration number if applicable.

- Specify if you are engaged in building, construction, or installation work in Sweden and identify where your goods or services are marketed from.

- Describe your operations in Sweden, including how you are paid, and any responsibilities your customers have regarding procurement, drawings, and labor management.

- For legal entities, provide details of partners including name, identity number, and ownership shares.

- Fill out the information required for VAT registration, including the start date of business operations subject to VAT.

- Complete the employer registration section detailing salary payment dates, estimated wage bill, and number of employees.

- Gather and attach all necessary documents such as a certificate of incorporation, proof of no unpaid taxes, a copy of your passport, and a power of attorney for the VAT representative.

- Provide information for the contact person or representative, including their name, phone number, and email.

- Lastly, ensure the application is signed by the applicant or the authorized person, documenting the date and providing a clarification of the signature.

- Once all sections have been completed, save your changes, download, print, or share the form as needed.

Begin your form-filling journey by obtaining the Skv 4632 online today.

Here are some effective methods for proofreading your documents. Do not rely on spelling and grammar checkers. ... Proofread for one error at a time. ... Read each word slowly. ... Divide the text into manageable chunks. ... Circle punctuation marks. ... Read the writing backwards. ... Note the errors you make on a frequent basis.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.