Loading

Get Virginia Form Pvi Application For Port Volume Increase Tax Credit Tax Year Submit This Form By

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Virginia Form PVI Application For Port Volume Increase Tax Credit online

This guide provides comprehensive steps on how to complete the Virginia Form PVI Application for Port Volume Increase Tax Credit online. Whether you are a business owner seeking tax credits for increased port volume or simply looking for guidance, this user-friendly resource will assist you in submitting the form correctly and efficiently.

Follow the steps to complete the application for port volume increase tax credit.

- Click ‘Get Form’ button to obtain the form and open it in your selected editor.

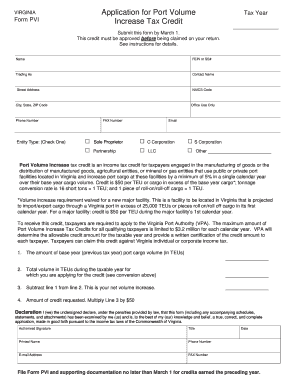

- Enter your name in the designated field on the form. Ensure that it matches the name associated with your tax entity.

- Fill in your Federal Employer Identification Number (FEIN) or Social Security Number (SS#) accurately.

- Provide the name under which you are trading in the 'Trading As' field.

- Include the contact name for your business. This should be a person who can be contacted regarding the application.

- Input your business's street address, city, state, and ZIP code accurately.

- Enter your phone number and email address for further communication regarding your application.

- Indicate the type of entity by checking the appropriate box; options include Sole Proprietor, C Corporation, S Corporation, Partnership, LLC, or Other.

- Section 1 requires you to state the amount of base year port cargo volume in TEUs (Twenty-foot Equivalent Units). Fill this out as per your records.

- Section 2 asks for the total volume in TEUs for the taxable year you are applying for.

- In Section 3, calculate your net volume increase by subtracting the base year volume from the total volume.

- In Section 4, calculate the amount of credit requested by multiplying the net volume increase from Section 3 by $50.

- Complete the declaration section by signing and dating the application. Ensure that the printed name matches the authorized signatory.

- Review all entries for accuracy and completeness before submission.

- Once finalized, save the changes, and you can download, print, or share the completed form as needed.

Complete your Virginia Form PVI Application online today to ensure timely processing and maximize your tax credits.

Due by May 1, 2023. Mail to the Department of Taxation, P.O. Box 1498, Richmond, Virginia 23218-1498.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.