Loading

Get Bensalem Business Privilege And Mercantile Tax Return

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Bensalem Business Privilege and Mercantile Tax Return online

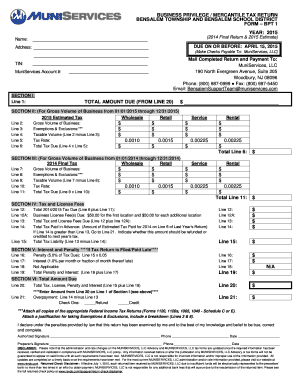

Filing the Bensalem Business Privilege and Mercantile Tax Return online is a key obligation for many business owners in the area. This guide provides a step-by-step approach to ensure you complete the form accurately and efficiently.

Follow the steps to successfully complete your tax return online.

- Press the ‘Get Form’ button to access the Bensalem Business Privilege and Mercantile Tax Return and open it in your online editor.

- Provide your business information, including the name and total identification number (TIN). Make sure to use the exact name registered with your business entities.

- Enter your address in the designated section of the form, ensuring it is accurate and complete.

- In Section I, fill in the total amount due from Line 20 in the appropriate field.

- Proceed to Section II. Report your gross volume of business for 2015, specifying the values for wholesale and retail sales in their designated lines.

- For each category under Section II, calculate and input your exemptions and exclusions as necessary, then determine your taxable volume.

- Apply the applicable tax rate to your taxable volume to compute the total tax due for this section.

- Move on to Section III, repeating the process for reporting gross volume and taxes related to the previous year (2014).

- In Section IV, finalize your tax obligations by specifying any business license fees, ensuring to include $50 for each business location.

- Calculate the total tax and license fees due, and compare with any advance payments made in previous years listed in Line 14.

- For any penalties and interest incurred from late payments, fill in Section V using the given formulas to compute these amounts.

- In Section VI, state the total amount due based on all previously calculated fields. Ensure accuracy as it affects your final submissions.

- Complete your return with your authorized signature and the date. If applicable, have the preparer also sign and include their contact information.

- At the final step, save your changes, then download or print the completed form for your records. You can also share it with relevant parties if needed.

Complete your Bensalem Business Privilege and Mercantile Tax Return online today for a smooth filing experience.

Payments can be made in cash, check or money order via mail or at the Bureau. No written payment plan is needed to make partial payments. Note that there is a $25 fee imposed for checks returned for insufficient funds. An Agreement to Stay Sale is available for properties that are in jeopardy of tax sale.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.