Loading

Get Roth Ira Distribution Request - Ally

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Roth IRA Distribution Request - Ally online

Completing the Roth IRA Distribution Request form with Ally can seem daunting, but this guide will provide you with clear, step-by-step instructions to assist you through the process. Ensure that all necessary information is accurately entered to facilitate your request.

Follow the steps to fill out the Roth IRA Distribution Request form effectively.

- Click ‘Get Form’ button to access the Roth IRA Distribution Request form and open it in your preferred editor.

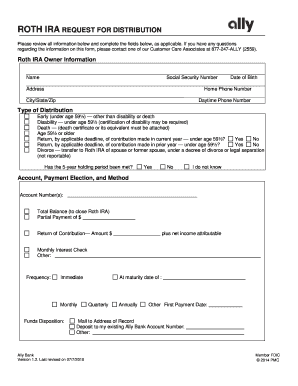

- Begin by entering your personal information in the 'Roth IRA Owner Information' section. This includes your name, Social Security number, address, date of birth, home phone number, city/state/zip, and daytime phone number.

- Next, designate the type of distribution you are requesting. Choose from options such as early distribution, disability, death, age-related distribution, or return of excess contribution, depending on your situation.

- Indicate if the five-year holding period has been met by selecting 'Yes,' 'No,' or 'I do not know.' This is crucial for determining the tax implications of your distribution.

- In the 'Account, Payment Election, and Method' section, provide your account number(s) and select how you would like to receive your funds, whether through a total balance withdrawal, partial payment, or return of contributions.

- Further specify the frequency of payments, if applicable. Options include immediate, monthly, quarterly, or annually. Ensure to provide any necessary additional information regarding the first payment date.

- Confirm the method of funds disposition you prefer. Choose to have the funds mailed to your address of record, deposited in an existing Ally Bank account, or specify another method.

- Finally, review all information for accuracy. Ensure that you have signed and dated the form, certifying that the information provided is true and correct. Know that this transaction may involve fees and you should consider seeking legal or tax advice.

- Once you have completed the form, you can save your changes, download, print, or share the completed Roth IRA Distribution Request form as needed.

Start the process today by filling out your Roth IRA Distribution Request form online.

Ally Bank Offers IRA Options. At Ally Bank, we offer IRA products for both traditional and Roth IRA CDs. With an Ally Bank IRA CD or IRA Online Savings Account, you can safeguard your retirement savings with deposits that are FDIC-insured up to the maximum amount allowed by law.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.