Loading

Get Limit Enhancement Request Form.cdr

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Limit Enhancement Request Form.cdr online

This guide provides step-by-step instructions for users on how to complete the Limit Enhancement Request Form online. By following this guide, you will efficiently navigate each section of the form, ensuring that all necessary information is accurately provided.

Follow the steps to complete the Limit Enhancement Request Form.cdr online

- Locate and click the ‘Get Form’ button to access the Limit Enhancement Request Form.cdr and open it in your online document editor.

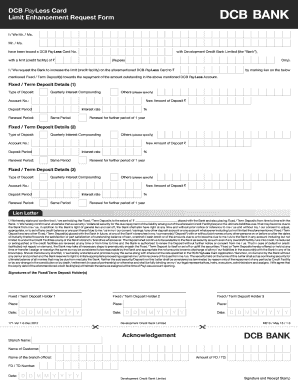

- Begin by entering your name in the designated fields, with the options for Mr. or Ms. included. Ensure accuracy and use the full name as it appears on your DCB PayLess Card.

- Provide your DCB PayLess Card number and current limit of your credit facility in the respective fields. Use numerals and clearly indicate the amount in rupees.

- Indicate your request for an increase in the limit by filling in the new desired limit in the appropriate section. Make sure to verify the new limit before submission.

- For the Fixed/Term Deposit Details, provide information for up to three deposits. State the type of deposit, the new deposit amount, account number, and other relevant details such as deposit and renewal periods.

- Read through the lien letter section carefully. Confirm and state your terms regarding the fixed or term deposits being used as collateral against the requested credit limit enhancement.

- Affix signatures in the section provided for all Fixed/Term Deposit Holder(s). Include the date of signature, ensuring all fields are accurately completed.

- After completing all sections, save your changes. You can then download, print, or share the form as necessary for submission or personal records.

Take the next step towards enhancing your credit limit by completing and submitting your Limit Enhancement Request Form online today.

Include most of the following information when you create your small business invoice: Unique invoice number. Date the goods or services were delivered. Description of the product or service. Amount payable with a due date. Payment terms and payment instructions. Last payment amount and date.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.