Loading

Get Alberta - Locked-in Release - Small Amount - Nov 06.doc

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Alberta - Locked-in Release - Small Amount - Nov 06.doc online

This guide provides clear and structured instructions on how to complete the Alberta - Locked-in Release - Small Amount - Nov 06.doc online. It is designed to assist users of all experience levels in accurately filling out the form required to release locked-in funds in Alberta.

Follow the steps to complete the form correctly.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

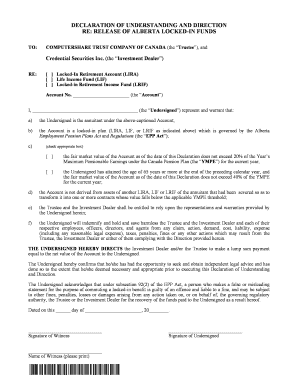

- Begin by filling out the section labeled 'TO:' with the names of the Trustee, which is Computershare Trust Company of Canada, and the Investment Dealer, Credential Securities Inc.

- Select the type of locked-in account you are releasing funds from by checking the appropriate box for Locked-In Retirement Account (LIRA), Life Income Fund (LIF), or Locked-in Retirement Income Fund (LRIF). Next, enter your account number in the designated field.

- In the section where you identify yourself as the 'Undersigned', provide your full name clearly.

- Review the declarations provided in items a) to f). Ensure that the information you provide is accurate, specifically regarding the locked-in plan and its fair market value conditions outlined.

- Select the appropriate box regarding the fair market value of your account as of the date of the declaration. Choose between the options provided based on your personal situation.

- After completing the required sections, sign the form in the designated area. An additional witness must also sign, so ensure you have a person available for this purpose.

- Once all sections are completed and verified, save any changes made to the form. You may then download, print, or share the completed document as needed.

Start completing your document online today to efficiently manage your locked-in funds.

Similar to an RRSP, the investments in your LIRA increase in value on a tax-deferred basis. However, unlike an RRSP there is no ability to make withdrawals from a LIRA. In Alberta, any time after age 50, the proceeds can be transferred to a LIF, and retirement income is initiated from the LIF account.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.