Loading

Get Wage And Health Benefits Report - New York Child Support

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the WAGE And HEALTH BENEFITS REPORT - New York Child Support online

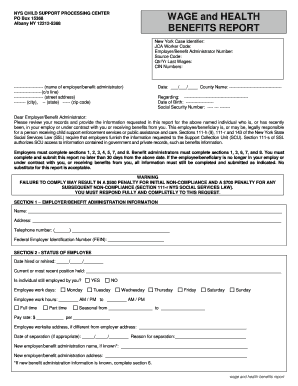

The WAGE And HEALTH BENEFITS REPORT is a necessary document for employers and benefit administrators to provide essential information regarding individuals who may be involved in child support enforcement. This guide offers clear and supportive instructions to help you complete the form accurately and efficiently.

Follow the steps to fill out the WAGE And HEALTH BENEFITS REPORT online.

- Click ‘Get Form’ button to access the WAGE And HEALTH BENEFITS REPORT and open it in your preferred editor.

- In section 1, provide the employer or benefit administrator information, including the name, address, contact details, and Federal Employer Identification Number (FEIN). Ensure all fields are filled out correctly.

- In section 2, indicate the status of the employee by providing details such as date of hire, position, employment status (yes or no), and work schedule. Be sure to include the pay rate and any relevant job separation information.

- In section 3, fill out the employee or beneficiary information, including mailing address, residential address (if different), social security number, and emergency contact details.

- In section 4, report the employee's wages based on the most recently filed W-2, including tax withheld amounts and any applicable deductions.

- In section 5, provide the current calendar year's earnings up to the date of filling out the form, including gross earnings and tax details.

- In section 6, detail the benefit information. Indicate the type of benefits received by the employee, their current status, the provider name if applicable, and the benefit amounts.

- In section 7, answer questions regarding health insurance benefits. If applicable, list dependents enrolled, health insurance carriers, policy identification numbers, and provide costs associated with the available healthcare plans.

- In section 8, complete the certification to confirm the accuracy of the information provided. This section must be signed and dated by the employer or an authorized designee.

- Finally, once all sections are completed, review the form for accuracy and completeness. After reviewing, you can save the changes, download a copy for your records, print it, or share the completed form as needed.

Start completing the WAGE And HEALTH BENEFITS REPORT online to ensure timely processing.

Bonuses and Lump Sum ReportingBonus and lump sum payments made to employees are considered income and may be garnished to collect past-due child support. ... Employers may report bonus or lump sum payments prior to payout by contacting California Child Support Services at lumpsumresponseteam@dcss.ca.gov or 916-464-6640.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.