Loading

Get Calstrs Hardship Withdrawal

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Calstrs Hardship Withdrawal online

This guide is designed to assist you in completing the Calstrs Hardship Withdrawal application online. It aims to provide clear, step-by-step instructions for each component of the form, ensuring that you can submit your application with confidence.

Follow the steps to successfully complete the form.

- Click ‘Get Form’ button to obtain the Calstrs Hardship Withdrawal application and open it in the editor.

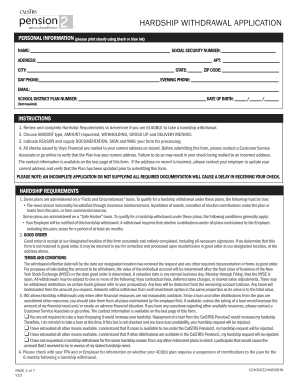

- Fill out your personal information clearly. This includes your name, social security number, primary phone number, and school district plan number. Ensure that all details are accurate to prevent any delays.

- Review the Hardship Requirements carefully to confirm your eligibility for a hardship withdrawal. Make sure you understand the criteria before proceeding.

- Select the amount type from which you wish to withdraw funds. Indicate whether you elect to receive funds from your designated Roth accounts and specify the amount you wish to withdraw.

- Choose your tax withholding options. Decide whether you want federal and state taxes withheld and indicate any additional amount to be withheld if applicable.

- Select your delivery method for the withdrawal. You can choose first-class mail, expedited delivery for a fee, or set up automated clearing house (ACH) deposits.

- Indicate the reason for your hardship withdrawal. You will need to provide supporting documentation for the chosen reason.

- Review all information on the application. Ensure that no required information or documentation is missing, as this could delay processing.

- Sign the application and date it. Make sure to check the authorization box confirming truthfulness in your claims.

- Finally, save your changes. You can download, print, or share your completed application as necessary.

Complete your Calstrs Hardship Withdrawal application online today!

Reasons for a 401(k) Hardship Withdrawal A 401(k) hardship withdrawal is allowed by the IRS if you have an "immediate and heavy financial need." The IRS lists the following as situations that might qualify for a 401(k) hardship withdrawal: Certain medical expenses. Burial or funeral costs.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.