Loading

Get Colorado Dr7118

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Colorado Dr7118 online

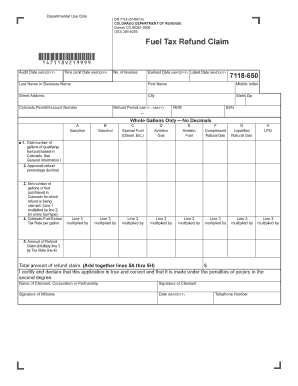

Filling out the Colorado Dr7118 form for a fuel tax refund can be straightforward when you have the right guidance. This user-friendly guide will walk you through each section of the form, ensuring you can accurately complete your claim online.

Follow the steps to accurately complete your fuel tax refund claim.

- Click the ‘Get Form’ button to access the Colorado Dr7118 document and open it in the online editor.

- In the section labeled 'General Information', read the eligibility criteria and refund conditions carefully. Make sure that your fuel usage meets the requirements.

- Record the total number of gallons of fuel purchased for qualifying uses in the specified fields (gasoline, gasohol, special fuel, aviation gas, aviation fuel, compressed natural gas, liquefied natural gas, and LPG). Ensure to enter whole gallons only, without decimals.

- Calculate the amount of refund claim by multiplying the net gallons of fuel claimed by the applicable tax rate. Enter these amounts in the appropriate sections.

- Read the declaration statement carefully, then certify and declare that the application is true and correct. Sign the form in the space provided.

Complete the Colorado Dr7118 online to ensure your fuel tax refund request is processed efficiently.

Additional charges associated with the delivery of the tangible property imposed by the seller, such as handling fees, hazardous fees, fuel surcharges, or other added fees are also subject to city tax.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.