Loading

Get Property Tax Return Form-6 ?? ! New... - Jnfoa

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Property Tax Return Form-6 online

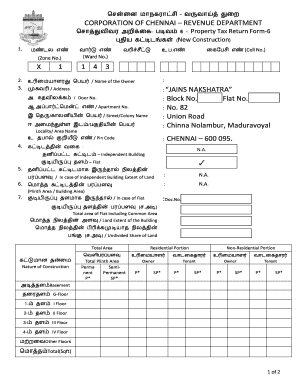

Filling out the Property Tax Return Form-6 is an essential step for property owners to declare their property details and ensure compliance with tax regulations. This guide will provide you with clear, step-by-step instructions to successfully complete the form online.

Follow the steps to complete the Property Tax Return Form-6.

- Click the ‘Get Form’ button to obtain the form and open it in your preferred document editor.

- Begin by filling in the property details, including Zone Number and Ward Number. Ensure accuracy as these are critical for property identification.

- Input the name of the owner and the complete address, including Door Number, Apartment Number, and Street or Colony Name. Double-check to avoid errors.

- Provide the Pin Code of the property location to ensure proper correspondence.

- Specify the nature of the property (Independent Building or Flat) and fill in the necessary dimensions such as Plinth Area, Building Area, and Land Extent for accurate valuation.

- Indicate the ownership type, listing if the property is residential or non-residential. If it is a special type of building, provide the relevant details.

- Complete the occupancy information of the building and provide dates such as when construction was completed and when the property was occupied.

- Make sure to read the declaration section and affirm that all information provided is correct by signing and dating the form.

- Once completed, review all the entered data for accuracy before saving changes.

- Finally, download, print, or share the completed form as necessary to submit it to the relevant tax authorities.

Start filling out the Property Tax Return Form-6 online now to ensure compliance and avoid penalties.

You can claim Foreign Tax Credit Relief when you report your overseas income in your Self Assessment tax return. You must register for Self Assessment before the 5th of October in any given year, and pay by 31st January the year after the tax year you're paying for.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.