Loading

Get W4p Form

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the W4p Form online

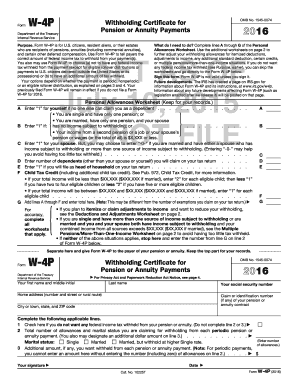

Filling out the W4p Form online is a straightforward process that allows individuals receiving pensions or annuities to communicate their federal income tax withholding preferences. This guide will walk you through each section of the form to ensure accurate completion.

Follow the steps to complete the W4p Form online efficiently.

- Click ‘Get Form’ button to obtain the W4p Form and open it in your digital editor.

- Begin with the Personal Allowances Worksheet. Complete lines A through G by entering details related to your dependency status, marital status, and number of dependents. This helps in determining the correct number of allowances.

- Move on to the main W4p Form. In the field for your name, enter your first name and middle initial, followed by your last name.

- Provide your social security number in the designated area, ensuring accuracy to avoid issues with withholding.

- Fill in your home address, including the city, state, and ZIP code, to ensure proper identification.

- In line 1, check the box if you do not want any federal income tax withheld from your payment. If you choose to have taxes withheld, proceed to lines 2 and 3.

- In line 2, indicate the total number of allowances you are claiming and select your marital status from the options provided.

- If you wish to have an additional amount withheld from your payments, specify the amount in line 3.

- Review all the information you have entered to ensure it is accurate. Make any necessary corrections before proceeding.

- Finally, sign and date the form to validate your entries. The form will not be processed without your signature.

- Upon completion, you can choose to save your changes, download, print, or share the completed W4p Form as necessary.

Start completing your documents online today for a hassle-free experience.

A comparative way of looking at the W-4P form is that it is the unearned income counterpart of the earned income Form W-4 (Employee's Withholding Certificate). When you work as an employee, the W-4 form is what you submit to your employer to set the tax-withholding ball in motion.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.