Loading

Get Application For Registration As An Ohio Withholding Agent Federal ...

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Application For Registration As An Ohio Withholding Agent online

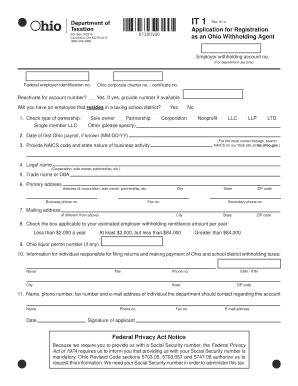

Filling out the Application For Registration As An Ohio Withholding Agent is a straightforward process that requires careful attention to detail. This guide will walk you through each section of the form to ensure you complete it accurately and efficiently.

Follow the steps to complete your registration application online.

- Press the ‘Get Form’ button to access the application form and open it for editing.

- Begin by entering your employer withholding account number if applicable. If not, leave this field blank.

- Fill in your federal employer identification number to identify your business for tax purposes.

- If your business is registered under an Ohio corporate charter, include that registration number here.

- Indicate whether you are reactivating an existing account by selecting 'Yes' or 'No.' If 'Yes,' provide the account number if you have it.

- State whether you will have an employee residing in a taxable school district by checking 'Yes' or 'No.'

- Select the type of ownership of your business from the options provided, such as Sole owner, Partnership, Corporation, or LLC.

- If known, input the date of your first payroll in Ohio using the MM/DD/YY format.

- Provide your NAICS code along with a brief description of your business activity.

- Enter the legal name of your business as registered (e.g., corporation, sole owner, partnership, etc.).

- If applicable, enter your trade name or doing business as (DBA) name.

- Input your primary business address, including street address, city, state, and ZIP code, as well as your business phone number and fax number.

- If your mailing address differs from your primary address, provide the mailing address details, including city, state, and ZIP code.

- Select the estimated annual employer withholding remittance amount by checking one of the three options.

- If you possess an Ohio liquor permit number, enter it in the designated field.

- Provide the contact information for the individual responsible for filing returns, including their name, title, contact number, and Social Security number or ITIN.

- Enter the name and contact details of the person the department should reach out to regarding this account, including phone number, fax number, and e-mail address.

- Review all entered information for accuracy, then sign and date the application before proceeding.

Complete your Application For Registration online today to ensure compliance and smooth processing.

Apply online at the Ohio Business Gateway to receive the number immediately upon completing the application. Find an existing Withholding Account Number: on Form IT-501, Employer's Payment of Ohio Tax Withheld. by calling the Dept of Taxation at (800) 282-1780.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.