Loading

Get October 2015 Su-050 Form Ut-5

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

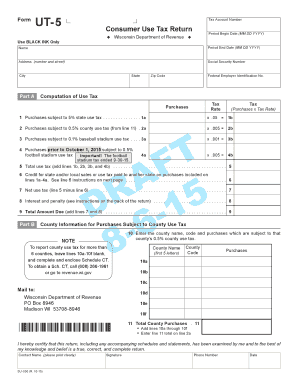

How to fill out the October 2015 SU-050 Form UT-5 online

Filling out the October 2015 SU-050 Form UT-5 online can streamline your tax return process. This guide provides detailed instructions to help you accurately complete and submit the Consumer Use Tax Return.

Follow the steps to complete the October 2015 SU-050 Form UT-5 online.

- Click ‘Get Form’ button to access the SU-050 Form UT-5 and open it in your editor.

- Enter your tax account number at the top of the form.

- Fill in your name, address, city, state, and zip code. Ensure each field is completed accurately.

- Input your Social Security Number or Federal Employer Identification Number as applicable.

- In Part A, compute the use tax by filling in the purchases subject to 5% state use tax, and multiply by 0.05. Record the result.

- Repeat the computation for any purchases subject to the 0.5% county use tax and the 0.1% baseball stadium use tax, applying their respective tax rates.

- If applicable, fill in costs related to the football stadium use tax and ensure it corresponds to purchases prior to October 1, 2015.

- Calculate the total use tax by adding all computed tax lines together, and place the sum in the total use tax field.

- If you have tax credits from other states, enter the amount on line 6, and then subtract it from your total use tax to find the net use tax.

- Factor in any interest and penalties as needed, leading to your total amount due by summing the net use tax and any penalties.

- Complete Part B by entering county information for purchases subject to county use tax, if applicable.

- Finally, print the completed form, sign it, and write the date. Do not forget to add your contact name and phone number.

- Once completed, save your changes, download the form, print it, or send it as required.

Start filling out your October 2015 SU-050 Form UT-5 online today to ensure timely processing.

Related links form

Close your sales and use tax account: Complete the Request to Close Account in My Tax Account, or. Email DORSalesandUse@wisconsin.gov, or. Call (608) 266–2776.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.