Loading

Get A 4p Form

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the A 4p Form online

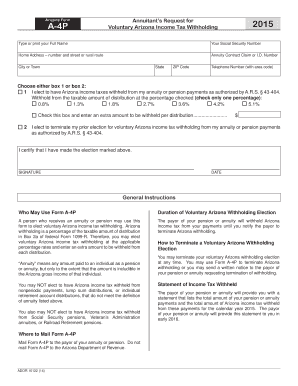

Filling out the A 4p Form online can streamline the process of electing voluntary Arizona income tax withholding from your annuity or pension payments. This guide will provide clear and detailed instructions to ensure you complete the form accurately and efficiently.

Follow the steps to complete the A 4p Form online.

- Press the ‘Get Form’ button to acquire the A 4p Form and open it in your online editor.

- Begin by typing or printing your full name in the designated field. This ensures that your submission is correctly identified.

- Enter your Social Security Number in the appropriate field. This information is crucial for processing your withholding election.

- Complete your home address, including the number and street or rural route, city or town, state, and ZIP code. Accurate contact information is essential for any correspondence regarding your withholding.

- Provide your telephone number, including the area code, in case the payor needs to contact you regarding your election.

- Choose either box 1 or box 2. If you elect to have Arizona income taxes withheld, check box 1 and select a percentage from the options provided. If you wish to terminate a previous election, check box 2.

- If applicable, check the box for additional withholding and enter the extra amount to be withheld per distribution.

- Sign and date the form to certify your election. This step confirms your agreement with the information provided.

- Once the form is completed, you can save your changes, download the document, print it, or share it as needed.

Complete your A 4p Form online today to ensure your voluntary Arizona income tax withholding is set up correctly.

As revised, Form W-4P is used for taxable periodic pension and annuity payments, and new Form W-4R is used for taxable non-periodic payments and eligible rollover distributions. Basically, the old W-4P was split into two forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.