Loading

Get Modelo 145

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the Modelo 145 online

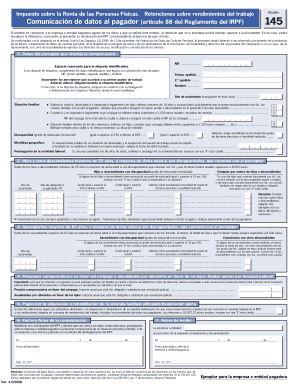

The Modelo 145 form is essential for individuals to communicate their personal and family situation to their employer for tax withholding. This guide will help you complete the form online effectively, ensuring accurate information is provided to avoid unnecessary tax withholdings.

Follow the steps to complete the Modelo 145 online.

- Click the ‘Get Form’ button to access the Modelo 145 and open it in the online editor.

- In the first section, fill in your Tax Identification Number (NIF) and your personal details, including your first surname, second surname, and first name. If you do not have labels, enter these details manually.

- Provide your year of birth and select your family situation from the given options, such as single, married, or divorced, among others. Make sure to fill out the NIF of your spouse if applicable.

- Indicate any recognized disability level and geographical mobility. If necessary, specify the date of moving to a new municipality for your job.

- Enter the details of any dependent children or descendants under the age of 25 (or older ones with disabilities) who live with you, ensuring to include their birth years and whether they have recognized disabilities.

- If you have dependent ascendants over the age of 65, fill in their details as required, including their birth years and disability status.

- Provide information regarding any compensatory pensions or child alimony mandated by a court order, including the annual amounts.

- If applicable, indicate any mortgage payments related to the acquisition or rehabilitation of your primary residence.

- Finally, sign and date the communication at the bottom, affirming that the information is accurate and submitting it to your employer. Review the form for correctness before submitting or printing it.

Complete your Modelo 145 online today to ensure accurate tax withholdings.

Cómo descargar y rellenar el modelo 145 Si necesitas comunicar alguna variación y tu empresa no te ha facilitado el formulario, puedes rellenar y descargar el modelo 145 en pdf desde la web de la Agencia Tributaria, a través de este enlace.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.