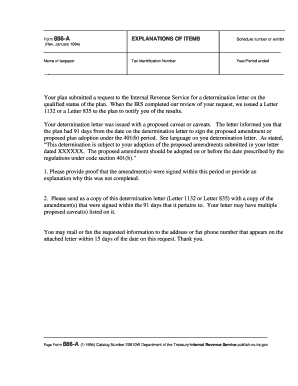

Get Irs 886-a 1994-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign IRS 886-A online

How to fill out and sign IRS 886-A online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

When you are not linked with document administration and legal processes, submitting IRS forms can be very tedious.

We recognize the importance of accurately completing documents.

Utilizing our platform can definitely facilitate professional completion of IRS 886-A, making everything convenient and secure for your tasks.

- Select the button Get Form to access it and start editing.

- Complete all necessary sections in the document with our robust PDF editor. Activate the Wizard Tool to make the process even easier.

- Verify the accuracy of the information provided.

- Insert the date of completing IRS 886-A. Utilize the Sign Tool to create your unique signature for document validation.

- Conclude editing by clicking Done.

- Send this document to the IRS through your preferred method: via email, using digital fax or postal mail.

- You can print it on paper if a physical copy is required and download or store it to your chosen cloud storage.

How to Modify Get IRS 886-A 1994: Tailor Forms Online

Utilize our robust online document editor while preparing your forms. Fill out the Get IRS 886-A 1994, specify the most important details, and effortlessly make any other necessary changes to its content.

Filling out documentation digitally is not only a time-saver but also provides an opportunity to modify the template according to your preferences. If you are going to handle the Get IRS 886-A 1994, think about completing it with our comprehensive online editing tools. Whether you make a mistake or input the requested information in the incorrect section, you can quickly adjust the document without the necessity to start over as you would with a manual fill-out. Furthermore, you can emphasize key data in your paperwork by highlighting specific sections with colors, underlining them, or encircling them.

Follow these quick and easy steps to finalize and adjust your Get IRS 886-A 1994 online:

Our dynamic online solutions are the most efficient way to prepare and alter Get IRS 886-A 1994 based on your needs. Use it to develop personal or business documents from anywhere. Access it in a browser, make any modifications to your forms, and return to them at any time in the future - they will all be securely stored in the cloud.

- Launch the form in the editor.

- Input the required information in the blank fields using Text, Check, and Cross tools.

- Navigate through the form to ensure you do not overlook any essential fields in the sample.

- Encircle some of the important details and attach a URL to it if needed.

- Use the Highlight or Line options to underscore the most crucial parts of the content.

- Choose colors and thickness for these lines to enhance your sample's appearance.

- Delete or obscure the information you do not want to be visible to others.

- Replace elements of content with errors and input the text that you require.

- Complete editing with the Done button when you are sure everything is accurate in the form.

Eligibility for the IRS hardship program typically encompasses individuals who can provide satisfactory evidence of financial distress. This might include unexpected medical expenses, job loss, or other significant financial burdens. Leveraging services like USLegalForms could simplify the application process and enhance the clarity of your hardship claim.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.